Are you tired of the errors and inefficiencies of manual invoice matching? Automating 3 way-matching can significantly improve efficiency. By automating the matching of invoices, purchase orders and good receipts notes, businesses can streamline their financial processes and minimize the risk of errors.

What is 3-Way Matching?

3-way matching is an accounting verification process that compares three documents to ensure the accuracy of an invoice before payment:

- The purchase order (PO).

- The good receipt note (GRN).

- The supplier’s invoice.

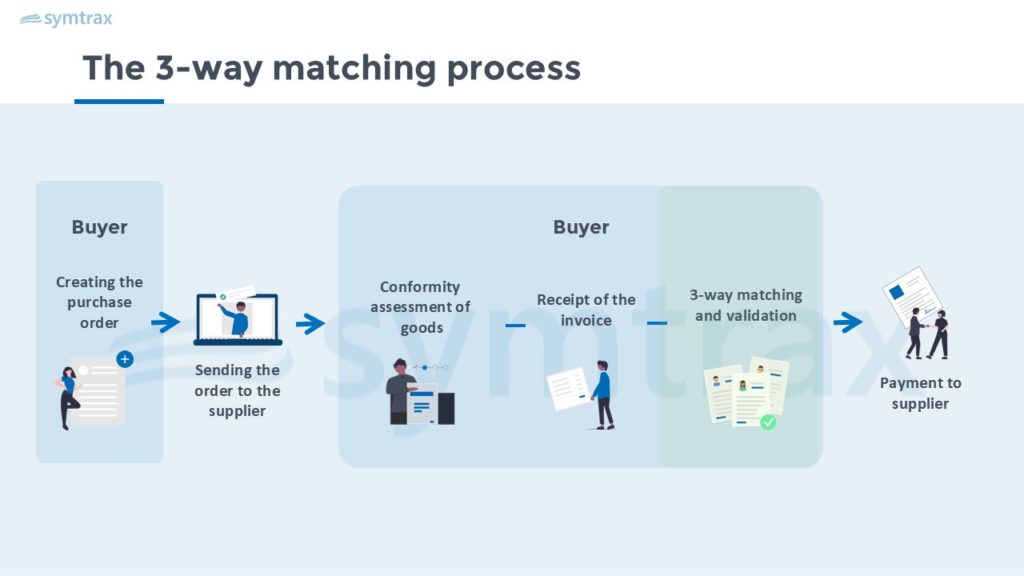

A Concrete Example of Manual 3-Way Matching :

When performed manually, the process of reconciling supplier invoices can be complex and error prone. Here’s a typical scenario:

Let’s take the example of a company that orders 100 smartphones from a supplier.

- Creating the purchase order

- The purchasing department creates a purchase order for 100 smartphones at a price of $1000 per unit, for a total of $100,000.

- The purchase order is then approved by the finance department and sent to the supplier. A copy is kept in the order system.

- Receiving the goods

- The supplier delivers 100 smartphones to the company.

- A GRN is created, where an employee verifies that the delivered items match the purchase order and enters the relevant data into the order system.

- The receiving department informs the purchasing and accounts payable departments that the smartphones have been delivered.

- Invoicing

- The supplier sends to the company an invoice of $100,000, corresponding to the 100 smartphones delivered.

- Matching

- The accounting department manually matches the invoice against the purchase order and the good receipt note. The objective is to verify that all information aligns across these documents. Key verification points include:

- The quantity of products (comparing what was ordered to what was received),

- The billed price versus the agreed-upon price,

- The product or service description,

- The order, delivery, and invoice dates.

- The company has found a pricing error on one of the invoice lines.

- The purchasing department is being asked to resolve this pricing discrepancy.

- Validation and payment

- Upon verification, the discrepancy was identified as a data entry error.

- With the error corrected, the invoice was validated by accounts payable.

- The invoice was then submitted to the ERP or accounting system for payment.

The Limits of Manual Matching

Manual three-way matching, performed by the accounting department, results in the laborious management of a significant amount of paper documents. This method not only lengthens processing times, but also exposes companies to many risks. The main challenges encountered are:

- Time lag: invoices are often received before the goods, causing a time lag that significantly complicates the matching process.

- Increased invoice volume: the increased volume of invoices, particularly for companies with numerous suppliers, significantly increases the workload of accounting teams and raises the risk of errors or omissions.

- Manual data entry: manual data entry can increase the risk of errors (such as incorrect order numbers, quantities or prices).

- Risk of documents loss: paper documents are at risk of being lost, which can lead to delays in processing and paying invoices.

- Limited visibility: without a centralized system for managing purchases, receipts, and invoices, it is difficult to track the status of orders and payments.

- Coordination challenges: reconciling documents often requires coordination between purchasing, receiving, and accounting departments. Poor communication and lack of standardized processes can result in errors.

Why Switch to an Automated Invoice Matching Process?

To address these challenges, implementing an automated solution for 3-way matching is essential.

The solution should be capable of:

- Automatically reading and extracting data from documents of various formats through OCR (Optical Character Recognition) technology.

- Centralizing and making available the information with all three documents (purchase order, goods receipt note, invoice) within a single interface.

- Automating the matching process between these documents to quickly identify discrepancies and alert the relevant departments.

- Implementing invoice approval workflows.

- Providing better visibility into spending commitments.

Seamless integration with existing systems is also crucial for smooth operation.

3-way Matching Optimization Technologies

Technological innovations are providing new ways to optimize the 3-way matching process.

- RPA (Robotic Process Automation) automates repetitive, low-value tasks like data entry and document comparison. This reduces human effort and significantly speeds up processes.

- Artificial Intelligence (AI) and Machine Learning (ML) make the matching process smarter and more efficient. By analyzing large datasets, these technologies can identify anomalies or discrepancies that humans might overlook. Machine Learning enables algorithms to detect risky transactions, errors, or potential fraud based on past behavior.

Benefits of Automating the 3-Way Matching Process

An effective 3-way matching process offers multiple advantages, including:

- Reduced errors

- Fraud prevention

- Process optimization

- Cost control

- Secure payment processes

- Improved relations with suppliers

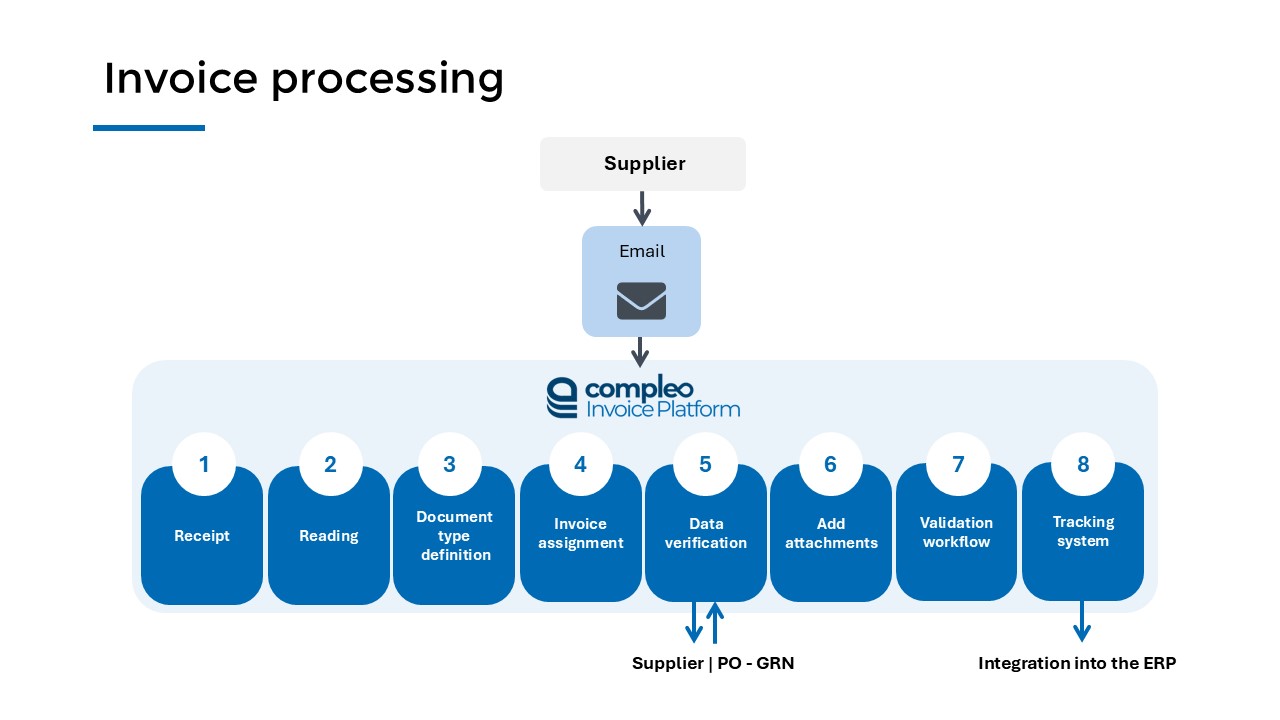

Our All-in-One Solution: Compleo Invoice Platform

Symtrax’s Compleo Invoice Platform seamlessly integrates with any ERP system. Powered by AI, this platform centralizes purchase order and supplier data in one place. With all relevant information accessible, it simplifies the matching of invoices, purchase orders, and GRNs.

The platform also allows you to attach files to invoices and establish internal approval workflows, making it easy to authorize invoices for payment. Additionally, Compleo Invoice Platform includes a tracking feature that enables you to monitor the status of each invoice.

Our solution is designed to support accounting teams by providing a centralized platform to make informed decisions, with the flexibility to customize processes to meet specific needs.