From 2024 to 2026, the French government is planning to implement generalized electronic invoicing and e-reporting. To this end, it has established the legal framework for large-scale mandatory e-invoicing between private companies (B2B), along with e-reporting (mainly meant for reporting VAT value to government). The main objective is to modernize the current tax system and reduce the VAT gap (EUR 13 billion).

What are e-invoicing and e-reporting?

E-invoicing in France

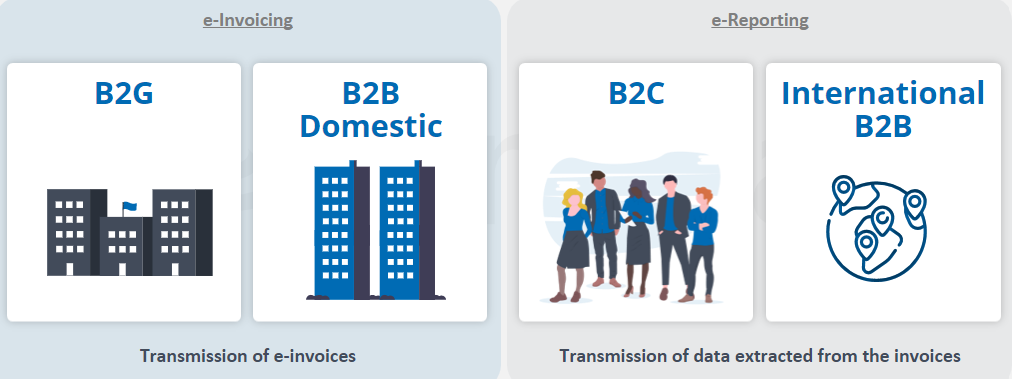

Electronic invoicing, or e-invoicing, is defined as “the interchange and storage of legally valid invoices in electronic format only between trading partners.” The e-invoicing transmission requirement only concerns Value Added Tax (VAT)-liable companies established in France. This will apply to all invoices for domestic goods and services sales between taxpayers (also known as B2B transactions).

Specifically, e-invoicing will be mandatory when:

- The supplier is a taxable person established in France.

- The buyer is a taxable person established in France.

- The operation is subject to French invoicing rules.

This implementation will combine e-invoicing with e-reporting or mandatory “electronic transmission of invoices data.”

E-reporting in France

E-reporting is a declaration system similar to that for e-invoicing for B2C and non-domestic B2B transactions.

For B2B transactions:

- The transaction must be between two taxable persons, one of whom is not established in France, or

- The transaction must be subject to VAT in France between two taxable persons not established in France.

For B2C transactions:

- The supplier must be established in France or

- If the supplier is not established in France, they must have some VAT requirements in the country.

When will electronic invoices become mandatory in France?

Timeline

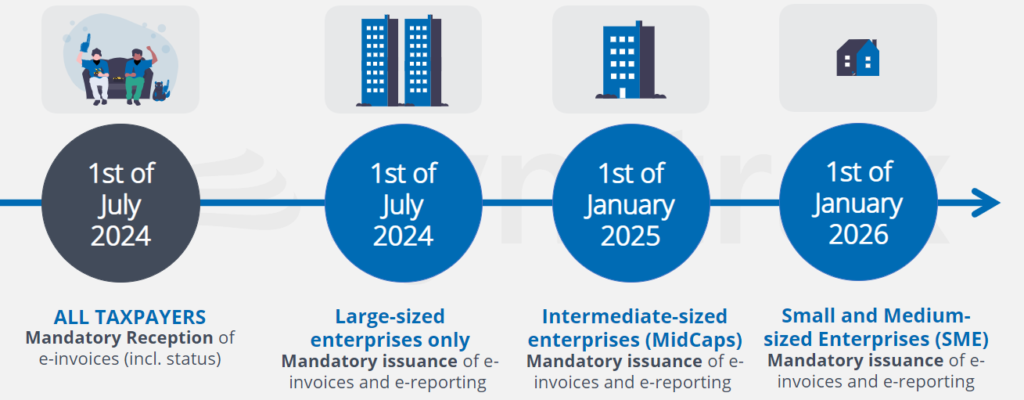

On 15 September 2021, the French Government adopted an ordinance (article 195 of the 2021 Finance Act) to generalize the use of e-invoicing for domestic B2B transactions and e-reporting. This mandate will take effect gradually between 2024 and 2026. The effects will depend on the size of the company and the rollout schedule.

The planned timeline is as follows:

Mandatory to receive e-invoices:

- 1st of July 2024 for all taxpayers

Mandatory to use e-invoicing and e-reporting:

- 1st of July 2024 (large-sized enterprises only)

- 1st of January 2025 (intermediate-sized enterprises aka MidCaps)

- 1st of January 2026 (small and medium-sized enterprises aka SME).

How will issuing an e-invoicing work?

The French Government has decided to opt for the Y model. This model allows taxpayers the option to transmit and receive their invoices and data by using either the public platform Chorus Pro (the “Portail Public de Facturation” or PPF) or a partner document dematerialisation platform (The “Plateforme de Dématérialisation Partenaire” or PDP).

Under the new article 289 bis and the Y-Scheme : e-invoices may no longer be transmitted directly from provider to client. Now, taxable companies will have to use the services of a dematerialization platform to transmit and receive electronic invoices and send transaction and payment data to the French administration.

These dematerialization platforms will help ensure:

- Issuing, transmitting, and receiving electronic invoices. These platforms will have the ability to transform the format of the invoice issued by the Supplier into onesuitable for the client and compatible with European e-Invoicing standards (see e-invoicing formats below). These operations confirm the data’s integrity, authenticity, readability, and accuracy.

- Extracting and submitting data: Certain data can be pulled directly from the invoice and sent to the tax authorities, including Supplier and customer identification, amount of VAT due, rate of VAT applied, and more..

- Transmitting transaction and payment data: Data that is not the subject of an electronic invoice can be sent to the tax authorities.

A central directory (“The Annuaire”) will list the companies covered by the e-invoicing requirement and will indicate the choice of partner platform(s) for each of them.

E-invoicing formats

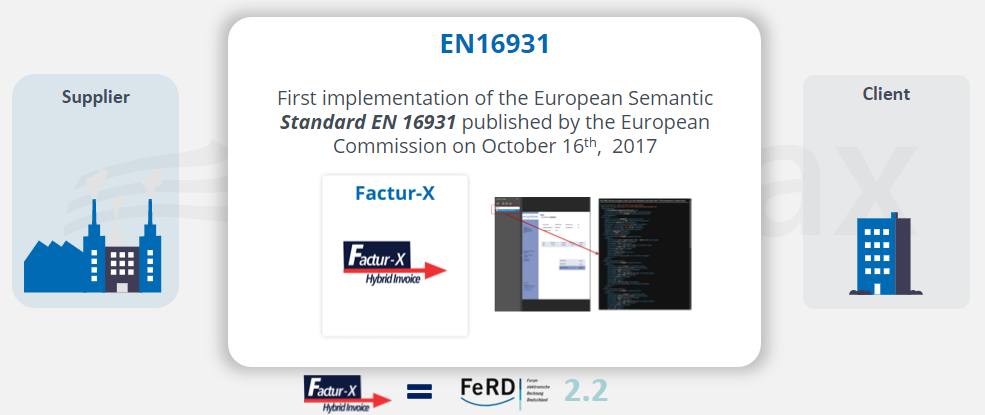

The French e-invoice follows the EU standard (EN16931). At first, invoices will be accepted in PDF format. The issue of invoices in PDF format will be accepted for the time. Then, according to the official guidelines, there will be three different structured formats: UBL 2.1, CII, and Factur-X. Factur-X is a combined human-readable PDF and XML file with invoice data in a structured form. PDP and PPF will be required to accept e-invoices issued in any of those formats. In addition,they must be able to issue invoices in any of those formats.

However, not all European member states have the same legislation. Furthermore, different business sectors require the their own sets of invoice fields. That’s why the European e-invoicing standard has proposed CIUS and its extensions. This includes additional information on the code of the administration receiving the invoice. It should be noted that the Chorus Pro portal enables the use of PEPPOL e-invoicing components, which allows e-invoices issued by foreign suppliers to be processed.

Why is this reform important?

E-invoicing provides great benefits both to the issuer and recipient. These new measures will allow participating companies to:

- Preven and fight against VAT fraud

- Strengthen business competition

- Promote the knowledge of company activities on an ad hoc basis

- Make VAT declarations easier by completing forms in advance

To learn more : The French tax authorities published a FAQ article about this new requirement.

Links