- Introduction

- What is OCR in Invoice Processing?

- Why OCR Falls Short in Modern Accounts Payable?

- What is AI/ML-based Invoice Processing?

- How does AI Invoice Processing work?

- OCR vs AI/ML in Invoice Processing

- Why AI-Powered Invoice Processing Makes a Difference?

- How Symtrax can help with AI-Powered Accounts Payable Solutions

- Next steps

Introduction

“OCR stops at reading. AI ensures it’s correct, complete, and usable.”

For decades, Accounts Payable (AP) teams have relied on manual data entry to process invoices, typing each field from paper into an ERP system. At low volumes, this approach was manageable, but as invoice volume grew, efficiency and accuracy quickly declined. This method is slow, costly, and unreliable, making it a major limitation in the procure-to-pay cycle.

To solve this, optical character recognition (OCR) technology emerged, marking a pivot shift from a manual, inefficient, and error-prone process to an automated and secure process.

But while OCR was a significant step forward, today AP teams face more complex challenges: invoices arriving in countless formats and layouts, from multiple regions, in different languages, through various channels, and physical copies.

This raises a critical question: Should your invoice processing start with an OCR reader, or is it time to move to AI/ML-first automation?

That’s why many enterprises are turning to AI for invoice automation a smarter, scalable way to handle financial documents.

In this blog, we’ll look at how invoice processing has grown beyond the limits of OCR and why AI-powered invoice automation is becoming the smarter choice.

What is OCR in Invoice Processing?

OCR technology refers to the process of converting scanned images, printed documents, or handwritten text into machine-readable digital text using electronic methods.

In OCR accounts payable workflows, the software identifies supplier names, invoice numbers, and other information (only as text or numeric characters) on an invoice and turns them into editable, searchable text for ERP processing, enabling faster and more accurate invoice data extraction.

Why OCR Falls Short in Modern Accounts Payable?

OCR transformed invoice data extraction but has clear limits today. OCR technology and OCR text recognition often fail on various layouts, poor scans, handwriting, or unusual fonts, which lowers capture accuracy. Image quality and limited language support further weaken reliability in OCR accounts payable workflows.

Lastly, it doesn’t understand context or interpret data.

For those gaps, intelligent data extraction powered by AI/ML is the next step —Accounts Payable just got a whole lot smarter.

What is AI/ML-based Invoice Processing?

AI for invoice processing integrates AP automation software with ERP systems, which uses machine learning (ML) to turn unstructured invoices into clean, validated data using intelligent document processing (IDP) or AI document processing. This approach doesn’t rely on fixed templates.

Unlike OCR, which struggles with layout changes, AI-driven extraction aligns more with document automation and document management.

How does AI Invoice Processing work?

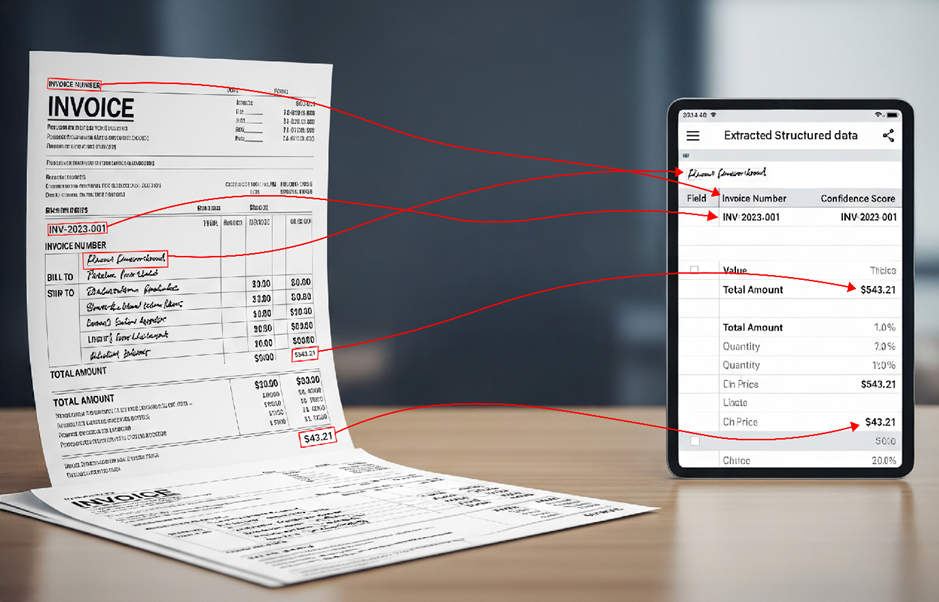

AI-powered invoice processing uses AI/ML to automatically capture, validate, and process invoices with greater speed and accuracy. AI invoice processing transforms fragmented, manual tasks into a streamlined, intelligent workflow. These are explained below:

- Unified Invoice Collection: All invoices are first collected from email, portals, scans, EDI, or physical copies into one system.

Managing various invoice formats often overlaps with automating incoming document management, ensuring consistency and visibility.

- Smart Data Extraction: After capture, AI-powered Intelligent Document Processing (IDP) extracts details like invoice number, vendor name, invoice dates, PO number, and other invoice data.

- Instant Data Checks: Once extracted, the data is instantly checked for missing fields, duplicates, and format errors.

- Automated 3-way Matching: Following validation, the system automatically matches the invoice, PO, and goods receipt (GRN) to reduce exceptions.

- Rule-Based Approval Workflows: With matches confirmed, invoices are routed for approval based on rules and authority levels.

- Faster Payment Cycle: After approval, invoices move directly into the payment queue, reducing turnaround time (TAT).

- Compliance and Audit Readiness: Each processed invoice is securely stored as a verified, traceable record for audits and reporting.

- Continuous Learning: Over time, AI and ML models learn from human corrections, making invoice automation smarter and more accurate.

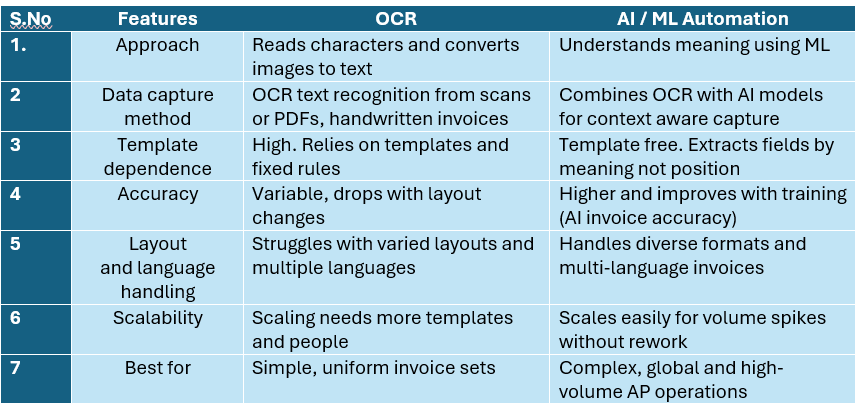

OCR vs AI/ML in Invoice Processing

Why AI-Powered Invoice Processing Makes a Difference?

- Lower processing costs: By reducing manual data entry and exceptions, AI cuts invoice handling costs upfront and delivers higher ROI.

- Higher accuracy: Machine learning (ML) goes beyond OCR, improving field recognition and minimizing errors compared with OCR capture.

- Better fraud and duplicate detection: AI detects anomalies and duplicate invoices early, preventing overpayments and fraud risks.

- Template free data capture (IDP): Intelligent Data Processing extracts data by context, so new vendor formats don’t disrupt workflows.

- Faster Turnaround and Cash Control: AI-driven validation and smart routing speed up invoice approvals, and shorten turnaround times

- Scalability for volume spikes: AI/ML process higher invoice volumes and without extra templates or manpower. In high-volume sectors, document automation accelerates logistics processes while maintaining accuracy and control.

- Improved compliance and audit readiness: Every invoice is stored as a validated, traceable record, ensuring audit readiness and reporting supported by enterprise document automation and document management.

- Fewer exceptions and less rework: With continuous learning, AI minimizes rework and frees AP teams to focus on higher-value tasks.

How Symtrax can help with AI-Powered Accounts Payable Solutions

Symtrax centralizes invoice capture across email, portals, scans, and EDI so all documents enter one intake stream. The Compleo Invoice Platform (CIP) uses intelligent data extraction and AI/ML invoice automation to handle multiple formats and languages without template rework, improving AI invoice accuracy compared to OCR only capture. Built-in validation, automated workflows, and 3-way matching reduce exceptions and speed approvals while keeping records audit-ready for compliance. Learn more on the Compleo Invoice Platform (CIP).

Next steps

Start with a quick assessment and a sample invoice pilot to compare OCR accounts payable metrics against an AI led approach. Request a demo of Compleo to see intelligent data extraction, automated approval flows, and 3-way matching in action, and get a short ROI estimate based on your volume.

Contact Symtrax to schedule the demo.