- Introduction

- What is e-invoicing in the UAE?

- Implementation Timeline & Phases released by MoF for UAE e-invoicing

- What Are the Mandatory Requirements for UAE e-invoicing Compliance?

- Invoice Formats and Mandatory Fields

- How to prepare for UAE e-invoicing?

- How it works: The “5-Corner” Model

- Who is Covered in the scope of UAE e-invoicing

- Who Is exempted from UAE e-invoicing?

- Penalties and fines

- Why choose Symtrax Software for UAE e-invoicing?

- Conclusion

- FAQ

Introduction

The United Arab Emirates (UAE) has moved beyond planning and is now issuing formal laws and timelines for the mandatory rollout of e-invoicing for business-to-business (B2B) and business-to-government (B2G) transactions.

The Ministry of Finance (MoF) and Federal Tax Authority (FTA) have finalized the legal framework and phased adoption schedule that apply to most VAT-registered businesses across the UAE. The e-invoicing system will utilize the Open Peppol network as a platform and the PINT AE (Peppol International – UAE Specialization) standard to digitize tax reporting across the emirates.

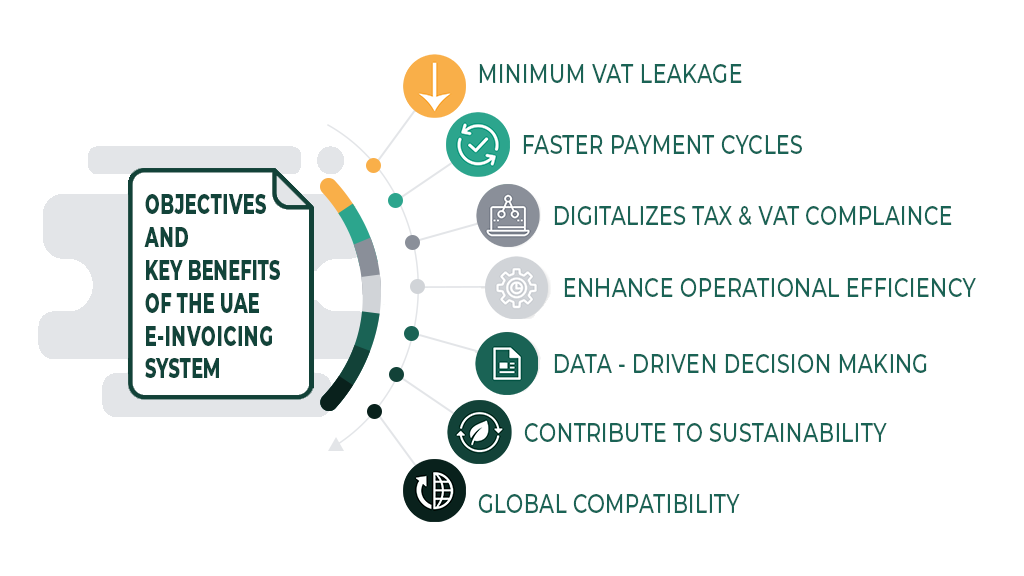

What is e-invoicing in the UAE?

E-invoicing in the UAE means issuing and exchanging invoice data between the supplier and buyer and reporting invoices and credit notes in a structured electronic format (XML/JSON using UBL or PINT) defined by the MoF.

Under the latest framework, e-Invoices must follow the PINT AE standard within the Peppol ecosystem and transmitted via Accredited Service Providers (ASPs)

Note: Unstructured invoices like PDFs, images, or emails do not qualify as compliant e-invoices.

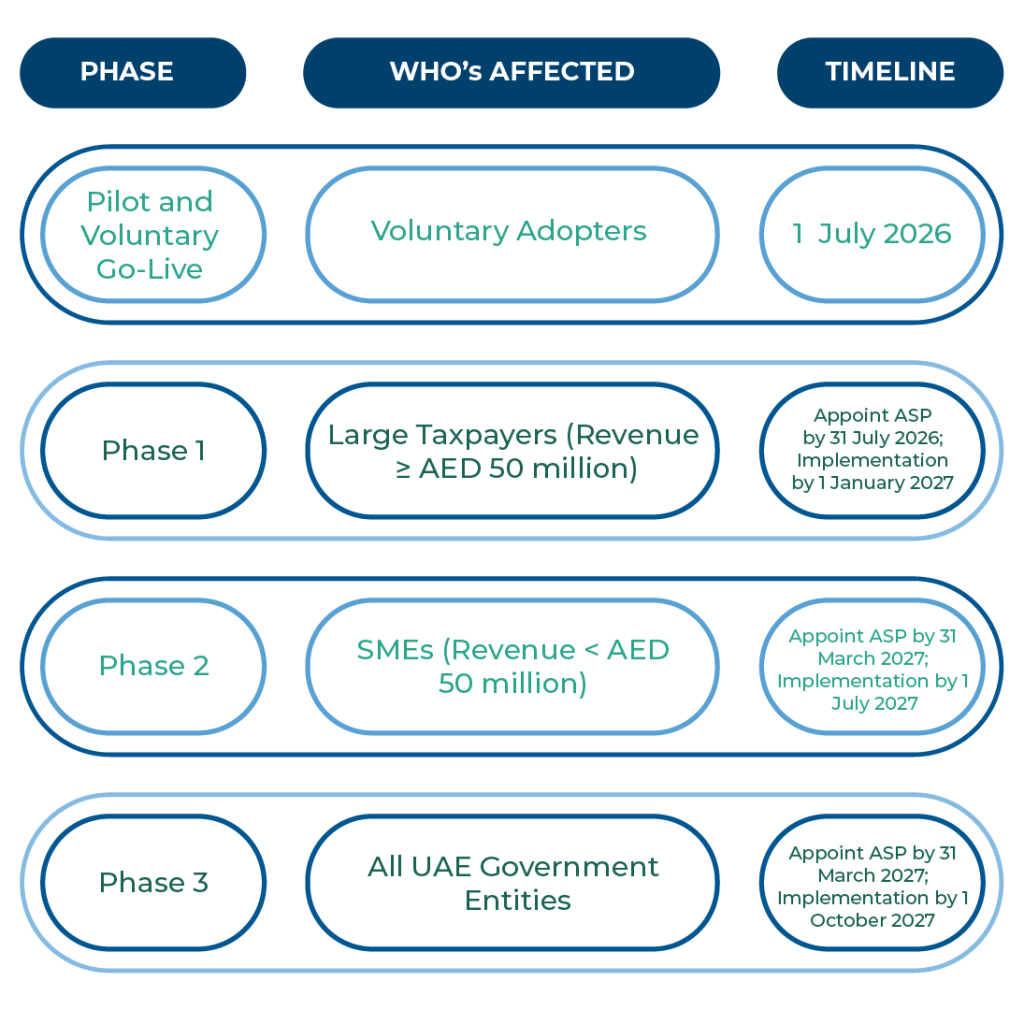

Implementation Timeline & Phases released by MoF for UAE e-invoicing

The UAE government has formalized the phased rollout of the electronic invoicing system through Ministerial Decisions No. 243 and 244 of 2025, as outlined in the table below.

What Are the Mandatory Requirements for UAE e-invoicing Compliance?

To comply with the UAE e-invoicing framework, businesses must meet the following requirements:

- Structured digital format and standards: Invoices and credit notes must be issued in a structured electronic format (XML or JSON) and comply with approved standards such as UBL or the PINT (Peppol Invoice Standard).

- Mandatory ASP usage: All invoice exchanges must be routed through a MoF Accredited Service Provider (ASP).

- Timely transmission: Invoices and credit notes must be transmitted through the e-invoicing system within 14 days of the transaction date.

- Mandatory data fields: Invoices must include all required fields, including supplier and buyer details, VAT registration numbers, tax rates, and tax amounts.

- Electronic credit notes: Credit notes must be issued electronically using the same format and system as e-invoices.

- Local data storage: Invoice and credit note data must be stored within the UAE in accordance with the Tax Procedures Law.

- System outage reporting: Any technical or system failure must be reported to the FTA within two business days, following the prescribed process.

Invoice Formats and Mandatory Fields

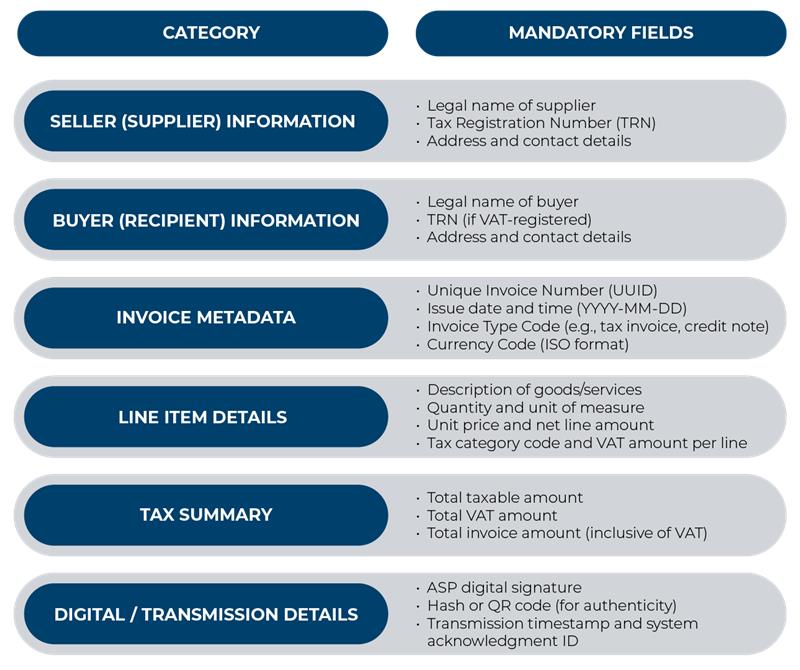

UAE e-invoicing mandates 50+ mandatory data fields (effective 2026) within a structured XML/JSON format defined by the PINT AE XML schema. While ASPs may accept internal ERP formats such as UBL or JSON, all invoices must be converted and transmitted in the PINT AE format to the FTA. Some of the key mandatory fields include:

How to prepare for UAE e-invoicing?

- Confirm Applicability and Scope

Determine whether your transactions fall under B2B or B2G e-invoicing requirements and identify the applicable phase based on your annual revenue and entity type.

- Assess ERP and Invoicing System Readiness

Evaluate whether your ERP can generate structured invoice data (XML/JSON) and support the required standards. Identify any gaps that require configuration or system upgrades.

- Appoint an Accredited Service Provider (ASP).

Select and onboard an MoF-accredited ASP to enable compliant invoice exchange, validation, and reporting through the Peppol network.

- Configure, Integrate, and Test

Configure invoice formats, mandatory data fields, and workflows. Perform end-to-end testing to ensure successful transmission, validation, and acknowledgment before go-live.

- Store e-invoices and credit notes within the UAE in line with the Tax Procedures Law. Implement secure archiving, audit-ready retrieval, real-time VAT reporting, and procedures to report system failures to the FTA within two business days.

How it works: The “5-Corner” Model

The UAE follows a Decentralized Continuous Transaction Controls and Exchange (DCTCE) e-invoicing framework. Unlike older models where you upload invoices manually to a portal, this system works in the background via the Peppol 5-Corner Model.

The five key components of the model are

- Corner 1 (Supplier): Generates the invoice in your ERP. The exact format and layout of invoice data

- Corner 2 (Sender ASP): The Accredited Service Provider validates the data, converts it to PINT AE, and reports key tax data to the FTA in real-time.

- Corner 3 (Receiver ASP): Receives and processes the invoice for the buyer.

- Corner 4 (Buyer): The buyer receives the validated e-invoice directly into their ERP.

- Corner 5 (FTA Platform): It acts as an invoice exchange platform and repository of invoices.

To understand how the Peppol 5-Corner Model compares to other global e-invoicing models, read our detailed guide on electronic invoice exchange models.

Who is Covered in the scope of UAE e-invoicing

Like other GCC e-invoicing mandates, including Saudi Arabia’s FATOORAH framework and Oman’s e-invoicing requirements, the UAE invoicing system is applicable to all taxpayers issuing invoices under the UAE VAT law. This includes businesses of all sizes engaged in business-to-business (B2B) and business-to-government (B2G) transactions.

Who Is exempted from UAE e-invoicing?

While the UAE e-invoicing framework covers most taxable transactions, certain activities are currently excluded from the mandate, particularly during the initial rollout phases:

- B2C Transactions: Retail and sales to end consumers are currently out of scope.

- Financial Services: Specifically VAT-exempt or zero-rated financial services.

- International Transport: Passenger airline tickets and international cargo (airway bills) are exempt for the first 24 months.

- Sovereign Activities: Government entities acting in a non-commercial, sovereign capacity.

Penalties and fines

Non-compliance with the UAE e-invoicing requirements may result in the following penalties:

- AED 5,000 per month: For failing to appoint an ASP by the deadline.

- AED 100 per invoice: For every invoice that is not issued in the compliant electronic format (capped at AED 5,000/month).

- AED 1,000 per day: For failing to report a system failure to the FTA .

Why choose Symtrax Software for UAE e-invoicing?

Symtrax, being a global e-invoicing solution provider with international e-invoicing expertise, ensures a smooth transition to the UAE e-invoicing mandate. Symtrax e-invoicing solution offers secure and compliant e-invoicing with digital audit trails for every transaction.

Key features:

- Quick Implementation

- Seamless integration with ERP and MoF/FTA Portal

- Peppol-enabled solution

- End-to-end invoice processing

- Generate digitally signed invoices

- 100% compliant with UAE’s e-invoicing regulations and VAT laws

Our tech-backed solution reduces the chances of any misconduct and ensures that only valid invoices are processed.

Conclusion

For businesses, the countdown to July 2026 has already begun. While the mandate is phased, the technical requirements for PINT AE and ASP integration are rigorous. The most successful transitions will come from organizations that treat this as a strategic digital transformation rather than a last-minute tax obligation. Now is the time to perform a thorough gap analysis of your current ERP capabilities and begin onboarding a reliable, accredited partner like Symtrax to ensure you are compliant long before the deadline hits.

FAQ

Businesses must appoint an Accredited Service Provider (ASP) to generate and transmit invoices in structured XML or JSON formats following the PINT-AE standard. The system operates on a “5-corner” model where invoices are validated by the ASP and reported to the Federal Tax Authority (FTA) in real time.

Integration is typically achieved by connecting your ERP or accounting software (like SAP, Oracle, or Microsoft Dynamics) to an ASP’s platform via an API or middleware. This allows your system to push transaction data to the ASP, which then handles the complex task of converting it into the required PINT-AE format and signing it digitally.

You must ensure your invoicing software captures all 50+ mandatory fields defined in the UAE Data Dictionary and then send that data to your ASP within 14 days of the transaction. The ASP will then validate the tax calculations, apply a digital signature, and transmit the compliant electronic record to both your customer and the FTA.

You can send a PDF as a visual copy, but it is not valid for tax purposes. The official legal invoice is the XML file transmitted through the ASP network.

Not necessarily. You need a middleware solution (like Symtrax) that can extract data from your current ERP and convert it into the required PINT AE format for the ASP

MLS is a status message from one ASP to another indicating whether a transmitted e-invoice is accepted, rejected, delivered, or failed to deliver.

In the UAE e-invoicing framework, invoices are exchanged between the supplier’s and buyer’s Accredited Service Providers (ASPs) over the Peppol network. The sender ASP validates and converts invoice data into the PINT AE format, then transmits it securely to the receiver ASP. At the same time, required tax data is reported to the FTA’s data platform.

Invoice validation is performed by the Accredited Service Provider (ASP), not by the FTA. The ASP checks each invoice against the PINT AE XML schema, mandatory data fields, VAT calculations, and technical rules before transmitting it to the buyer and reporting tax data to the FTA.

If validation fails, the invoice is rejected and not transmitted to the buyer or reported as compliant. The sender must correct the errors and resend the invoice through the ASP.

No. Error codes and validation failures are handled at the ASP level. Only successfully processed and reported tax data is transmitted to the FTA platform.