- Why are these Models Called Corners?

- The 2-Corner Model: Direct Supplier-to-Buyer

- The 3-Corner Model: Introducing a Service Provider

- How does the 3-Corner Model work?

- The 4-Corner Model: A Decentralized Interoperable Network

- How does the 4-Corner Model Work?

- The 5-Corner Model (DCTCE Model): Decentralized model with e-reporting

- How does the 5-Corner Model work?

Every organization exchanges information with various business partners, forming a wide communication network. Over time, various types of networks have developed based on the technical and organizational approaches taken.

Each model comes with its own advantages and challenges. These networks matter even more in the context of electronic invoicing, which requires secure, efficient, and traceable exchanges between buyers and suppliers.

Why are these Models Called Corners?

The term “corner” refers to the participants involved in transmitting electronic documents: the seller, the buyer, service providers, and sometimes even a tax authority.

The number of corners determines the number of participants involved in the exchange, as well as the technical architecture and responsibilities of each participant in the network.

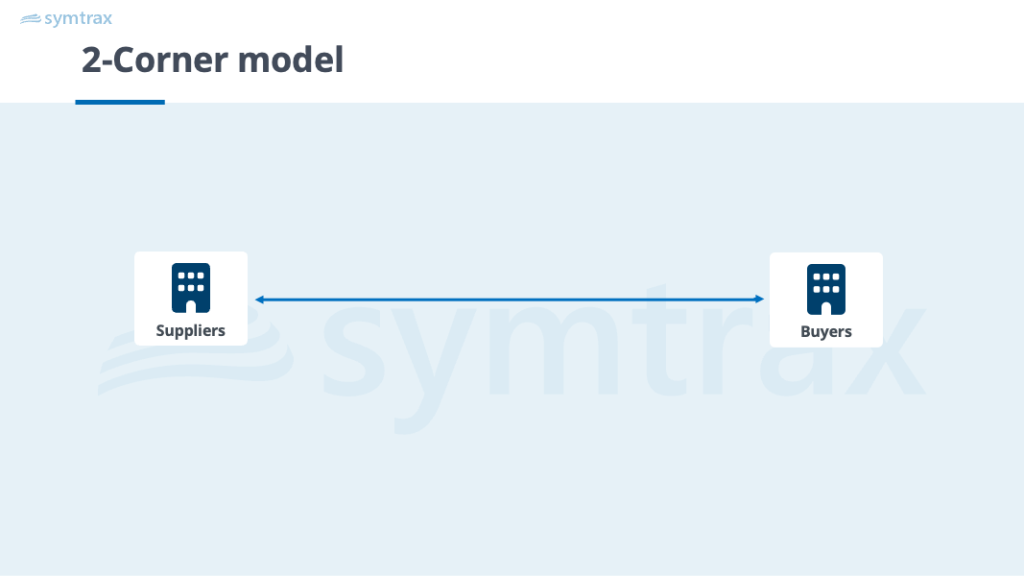

The 2-Corner Model: Direct Supplier-to-Buyer

In the “2-corner” model, communication happens directly between the supplier (invoice issuer) and the customer (invoice receiver). There is no intermediary, and both parties must agree on the invoice format and the transmission method (for example, EDI via FTP or AS2).

Pros of the 2-Corner Model

- Simplicity: This model is simple and gives full control to the supplier and the buyer, without depending on a third party.

- High automation: It’s particularly suitable for businesses with established relationships, fewer trading suppliers, and high volumes. Common in sectors such as retail, automotive, and healthcare.

Cons of the 2-Corner Model

- Low interoperability: the 2-corner model requires both parties to set up and maintain compatible systems, which limits flexibility and connectivity with other platforms.

- Low scalability: Every new connection requires a specific technical setup, making integration and maintenance expensive and difficult to extend in a large setup.

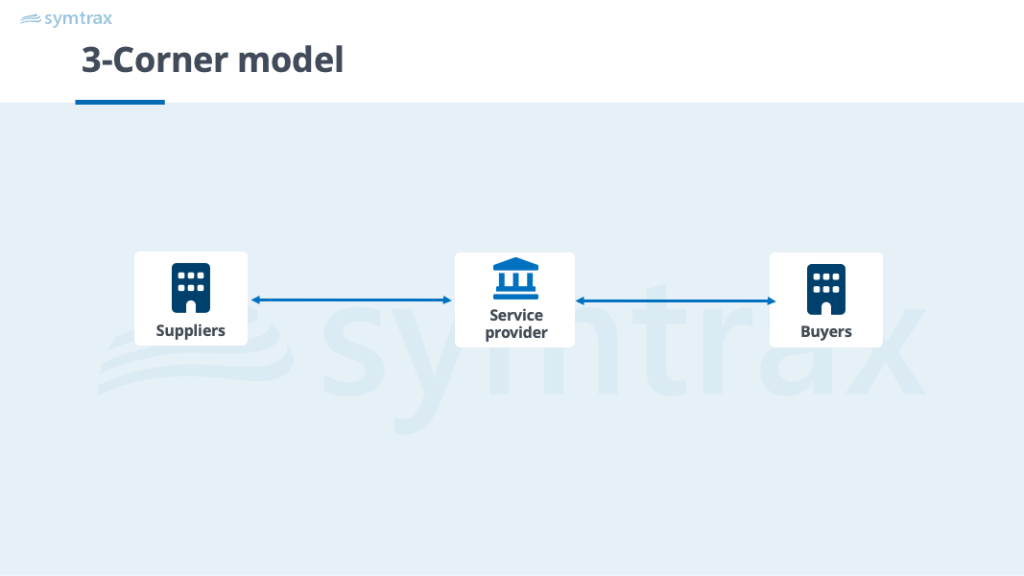

The 3-Corner Model: Introducing a Service Provider

The 3-corner model introduces an intermediary (usually a service provider or government platform) that manages invoice exchanges between supplier and buyer.

How does the 3-Corner Model work?

- The supplier generates the invoice and sends it to the intermediary, who:

- Validates the format and content of the invoice (according to the buyer’s or regulatory specifications).

- Converts the invoice into the format expected by the buyer (e.g., from a PDF to a Factur-X format).

- Sends the validated invoice to the buyer using the appropriate channel (EDI, API, portal, etc.).

- The buyer receives and integrates the invoice into their ERP or accounting system.

Pros of the 3-Corner Model

- Added value: The intermediary handles transmission, format conversion, data validation, and sometimes even legal archiving.

- Regulatory alignment: Service providers make sure that invoices meet legal requirements.

Cons of the 3-Corner Model

- Limited “network effect”: The network value depends on how many suppliers are connected to the same provider. If each supplier picks up a different provider, there could be compatibility issues or the need for double connections, reducing efficiency.

- Dependency: Deploying an intermediary introduces additional subscription costs and dependence on its reliability and performance.

- Regulatory constraints: Government-mandated platforms (e.g., Chorus Pro in France, SDI in Italy, and KSeF in Poland) may require businesses to follow specific formats or connection rules.

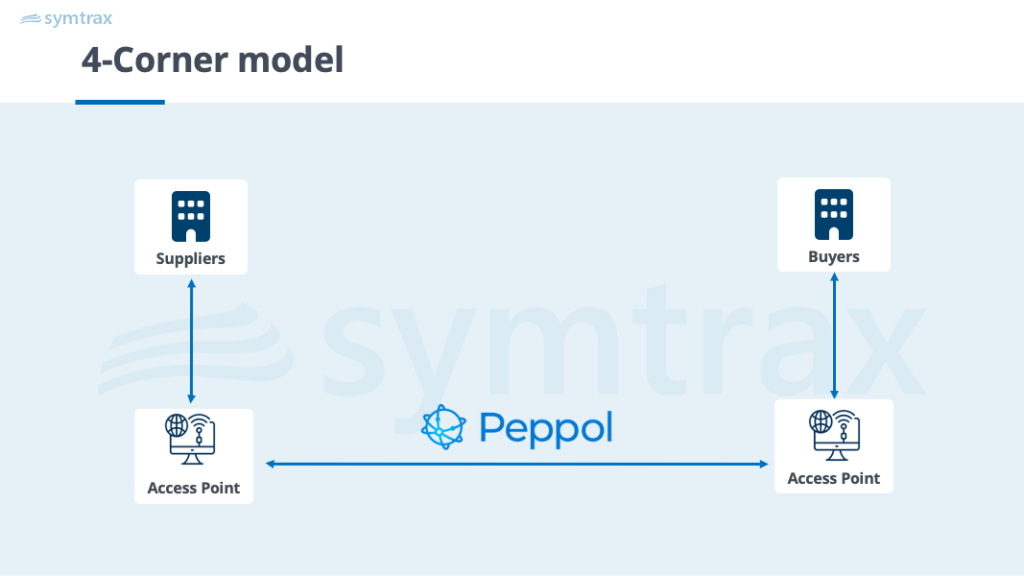

The 4-Corner Model: A Decentralized Interoperable Network

The “4-corner” model uses a decentralized architecture in which each participant (supplier and buyer) freely chooses its service provider (called an Access Point). These Access Points communicate with each other using common interoperability protocols and standards, ensuring smooth, secure, and compliant invoice exchanges.

Example:

A widely used example of this model is Peppol, recognized for its interoperability framework

How does the 4-Corner Model Work?

The 4 “corners” are:

- The supplier’s system

- The supplier’s Access Point

- The buyer’s Access Point

- The buyer’s system

Service providers must establish interoperability agreements (legal, technical, and commercial) with each other to ensure the proper delivery of messages. This includes compliance with data formats (such as UBL or CII), communication protocols (AS4, REST, etc.), and adherence to regulatory requirements (authenticity, integrity, archiving, etc.).

Pros of the 4-Corner Model

- Scalability: By connecting to a single certified access point, companies can exchange invoices with all participants on the network.

- Enhanced security: Certified Access Points must comply with strict standards ensuring regulatory compliance and data security.

- Global Interoperability: Thanks to organizations like Open Peppol, GENA (Global Exchange Network Association), and DBNA (Digital Business Networks Alliance), international standards are emerging to facilitate cross-border exchanges

Cons of the 4-Corner Model

- Coordination required: Smooth operation requires consistent communication between access points.

- Service costs: Providers may charge subscription or volume-based fees for access points.

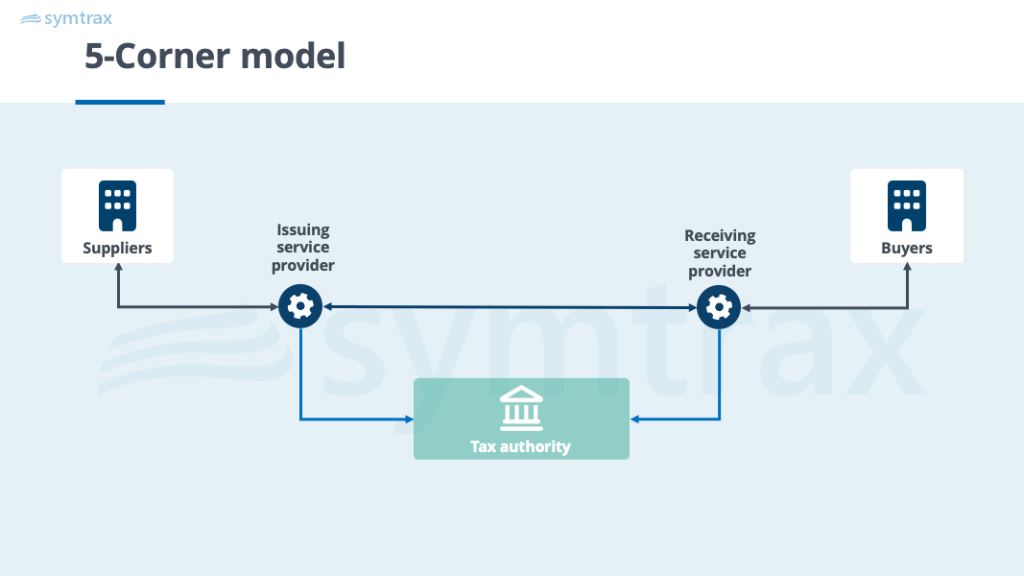

The 5-Corner Model (DCTCE Model): Decentralized model with e-reporting

The “5-corner” model is an evolution of the 4-corner model, adding a fifth component: the tax authority. This is often referred to as the DCTCE model (Decentralized Continuous Transaction Controls and Exchange). It combines two key functions: electronic invoice exchange between businesses and real-time or near real-time reporting of tax-relevant data to the tax authority (e-reporting).

How does the 5-Corner Model work?

- Businesses use a certified service provider to issue, receive, and process invoices.

- Providers exchange invoices through an interoperability network (often Peppol).

- At the same time, they transmit required tax-relevant data to the tax authority in real time.

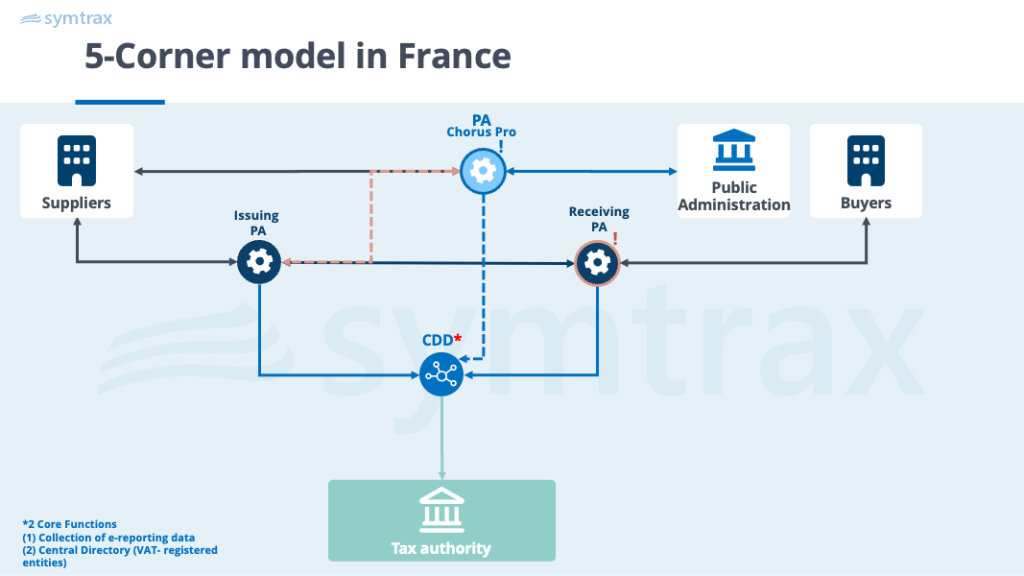

Example: How France Uses the 5-Corner Model

The French system follows a Y-shaped structure and illustrates an advanced implementation of the 5-corner model. The first two branches represent the exchange of invoices, covering both issuing and receiving, through approved platforms (Plateformes Agréées or PA) as part of the e-invoicing process. The third branch is dedicated to e-reporting, where invoice, transaction, and payment data are submitted to the tax authority through the Public Portal (PPF). Although it may seem complex, this model provides strong flexibility because businesses can choose any certified provider while remaining fully compliant.

👉How Symtrax supports enterprise e-invoicing and compliance.