ZATCA AND KSA E- INVOICING IN BRIEF

The Kingdom of Saudi Arabia (KSA) has announced the inclusion of e-invoicing system Fatoorah under the Zakat, Tax and Customs Authority (ZATCA). The Fatoorah is an initiative to convert paper-based billing and notes into an electronic invoicing system.

In a nutshell, keeping only a paper-based billing system will be prohibited and penalized by law. Generating E- invoices will be applicable for people and industries liable to pay VAT.

This will require any taxable person / business in KSA to generate invoices, credit notes, and debit notes in an electronic format and submit them in a pre-defined format on the portal for verification. This will be mandatory once the implementation of Fatoorah is complete.

Some of the main purposes of Fatoorah implementation are to:

- Enrich fair trade and competition

- Protect consumers through a unified and streamlined process

- Prevent illegal transaction

According to the information provided by ZATCA, the compliance is to be completed by all enterprises in two phases for effective and efficient compliance.

Invoices to be registered with Fatoorah

Businesses are involved in multiple invoice transactions each day. The type can be categorized based on the industry and type of business being done.

Standard invoice

Standard invoices are tax invoices relevant to B2B and B2G transactions. These are primarily used for demanding VAT input deductions by buyers. These are also necessary for all companies pertaining to exporting goods, regardless of supply value or the customer’s status.

Simplified invoice

These invoices are like any other type of electronic invoice, where mentioning the buyer’s name and details is not mandatory. These invoices, in most cases, are applicable to B2C transactions and other situations where VAT inclusion is not necessary.

The only exceptions are simplified invoices generated for private medical and educational institutes that require mention of the VAT component (treated as “zero component”).

Have you complied with the Generation Phase?

The ZATCA has implemented Fatoorah in two phases for effective adoption of the E-invoicing system.

The implementation of Phase 1 was launched on December 4th, 2021.

In this phase, the taxable entities and trades were expected to store their invoices, bills, credit notes, and debit notes electronically. These invoices need to be in both XML and human-readable formats like PDF with a QR code included for simplified invoicing and taxpayer information.

The taxpayers are not expected to submit their bills on the FATOORAH portal. However, during this phase, they are expected to equip and make their systems E-invoicing compliant.

Click here for more information on the Fatoorah generation phase.

What is expected in the Integration Phase?

This is the stage during which taxable businesses are expected to generate invoices electronically and submit them for verification on the Fatoorah portal beginning on January 1st, 2023.

The implementation of this phase would happen in waves, with the taxpayers in the first wave selected based on their revenue and notified six months prior to the implementation date. The invoicing solution opted by the taxpayer is designed to generate the following elements when submitting the invoices to the ZATCA portal for verification:

| UUID |

|

| Cryptographic Stamp |

|

| Cryptographic Stamp Identifier |

|

| Previous Invoice Hash |

|

| QR Code |

|

| Invoice Counter |

|

These are just some of the critical E-invoicing system aspects. Click ZATCA E-INVOICING for more details on Fatoorah guidelines.

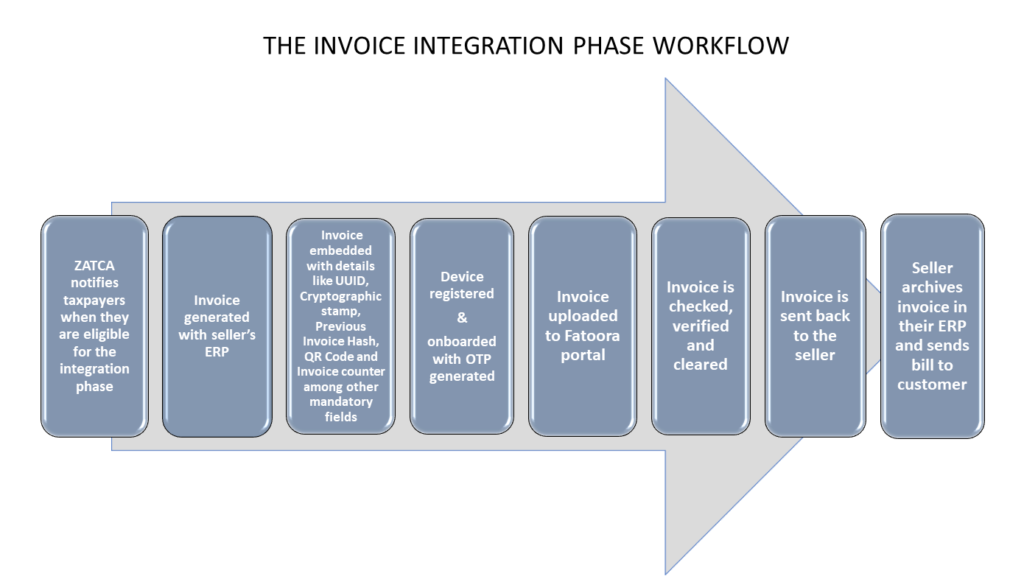

Systematic E-invoicing Process

Any taxpayer is to follow a standardized workflow for submitting the invoices on the ZATCA portal.

The workflow for the submission of invoices is as follows:

What are the benefits of choosing Symtrax for KSA compliance?

With the new Fatoorah system, the KSA has strengthened its taxation system. Symtrax strives to provide a seamless and hassle-free experience for clients in their journey to ZATCA compliance.

Our solution aims to meet the KSA’s Fatoorah compliance with end-to-end automation for greater efficiency.

These are some of our key features:

- Complete Compliance

Symtrax ensures an efficient way to generate QR Codes, UUID, Cryptographic stamp, invoice hash, and all other requirements for Fatoorah compliance.

- End-to-End Compliance

Our solution integrates with ZATCA systems without disrupting your existing setup. Compleo allows for complete automation, including conversion and secured storage. With enhanced automated buyer-facing distribution capabilities, manual intervention is no longer needed

- Real-time monitoring and tracking

Once the bill is generated, e-invoicing ensures the invoice is tamper-proof by removing the need for manual input. In addition, our system guarantees user rights and authorized credentials with complete security and monitoring.

- Secure communication via API

Our API-based EDI ensures that third-party entities do not access private systems. We act as a mediator for exchanging data while keeping it secure.

- Increase productivity with RPA

When paired with our other solutions, e-invoicing can automate your workflow and documentation processes, helping to reduce manual workloads by 50%. Workflow automation also helps:

- Accountability

- Going paperless

- Increasing customer satisfaction by ensuring speedy processes and reducing errors

- Analysis

- Quick Implementation

Our solutions are equipped to make your compliance journey seamless and can be implemented within days while remaining external to your system. You are also provided with a user-friendly application to monitor all your processes. What’s more, our SAP connectors prove to be an effective solution for seamless integration with your ERP. The solution also provides support and online help manuals in Arabic.

Conclusion

Every business expects the invoicing solution they adopt to make submission on the portal easy to implement and hassle- free.

Reducing manual dependency is another major consideration.

Our solution lets you meet these expectations and provide clients more than just invoice compliance. End-to-end automation also amplifies workforce efficiency with minimum manual intervention, ensuring no errors. Other Symtrax solutions can help clients streamline their workflows, improve their business processes, and more. Contact us today to schedule a consultation and find out which solution is best for you.