- Introduction: The Rising Pressure on AP Departments

- Digitizing Accounts Payable: A Smart Move for Growing Businesses

- The Problems in AP Process for MSMEs

- Real-World Impact: AP Automation Success Stories for MSMEs

- What AP Digitization Looks Like in Practice

- How to Get Started with AP Digitization

- Conclusion: The Time to Act Is Now

Introduction: The Rising Pressure on AP Departments

“The problem isn’t your ERP; it’s what your ERP doesn’t do.“

Accounts Payable (AP) teams in Micro, Small, and Medium Enterprises (MSMEs) are facing rising pressure from inflation, cost controls, and increased operational scrutiny. These departments are expected to reduce expenses, accelerate invoice processing, and improve cash payable visibility without compromising compliance or vendor relationships.

Beyond just balancing the books, AP is now a vital function that directly impacts supplier relationships and overall business agility. Vendor payment delays, unreconciled GST, and outdated records often lead to CEO escalations, poor audit outcomes, and cost leakage.

Despite the known drawbacks, many MSMEs still use paper-based workflows and manual invoice approvals, leading to inefficiencies, as outlined in this article. On top of that, AP teams face challenges such as

- Higher workloads during seasonal demand surges , MSMEs often face invoice spikes during festive or peak seasons, which leads to increased AP volume, requiring faster invoice processing.

- Physical document storage, making audits time-consuming and compliance harder to achieve.

- Staffing challenges, with higher salary demands and fewer skilled professionals.

- A growing risk of fraud and financial misreporting due to fragmented approval processes.

- Difficulty adapting to remote and hybrid work models, which require cloud-based invoicing solutions.

Digitizing Accounts Payable: A Smart Move for Growing Businesses

Manual AP processes create a ripple effect of inefficiencies for MSMEs. From inefficient data entry and invoice tracking issues to lost invoices, delayed approvals, and invoice errors, the risks are high. These outdated methods also create fraud vulnerabilities, audit challenges, and cash flow visibility issues, making it harder to manage payables effectively. Despite these challenges, digital adoption remains limited.

“According to a RedSeer report, only around 12% of India’s 64 million MSMEs, roughly 7.7 million, have reached digital maturity, highlighting the vast untapped potential for automation.“

Without AP automation software, teams face resource overload and struggle to reconcile data across disconnected systems. In contrast, digital transformation through cloud-based invoicing and AP automation solutions ensures faster turnaround and full control over the accounts payable workflow.

If your AP process is still running on spreadsheets and email threads, it’s not just inefficient—it’s holding your business back. Discover why manual processing is costing you more than you realize.

The Problems in AP Process for MSMEs

Although most accounts payable workflows haven’t changed as fast, the volume and complexity of invoice processing rise with the size of businesses. Although SAP Business One, Microsoft Dynamics 365 Business Central, Oracle NetSuite, Acumatica, and JD Edwards (JDE) provide mid-sized businesses strong financial bases, they collapse in terms of sophisticated workflow features, invoice automation, and compliance.

Here’s where these systems reveal critical gaps:

- Invoice Data Capture & OCR: Most ERPs don’t offer built-in OCR or AI-powered data capture. This leads to manual data entry, increasing the risk of errors and slowing down processing. Add-ons are often required to automate invoice scanning and extraction.

- Approval Workflow Limitations: Standard approval routing in many ERPs lacks automation, mobility, and exception handling. Complex invoice workflows often need third-party platforms with multi-level approvals.

- PO Matching Accuracy: Basic PO matching lacks intelligent automation. High-volume or exception-prone matching requires external solutions that offer smart 2-way or 3-way matching with tolerance checks.

- Audit Trails & Compliance Readiness ERP logs often fail to meet audit-ready standards for AP. Full visibility, digital traceability, and compliance validation features are typically available only through dedicated AP platforms.

Real-World Impact: AP Automation Success Stories for MSMEs

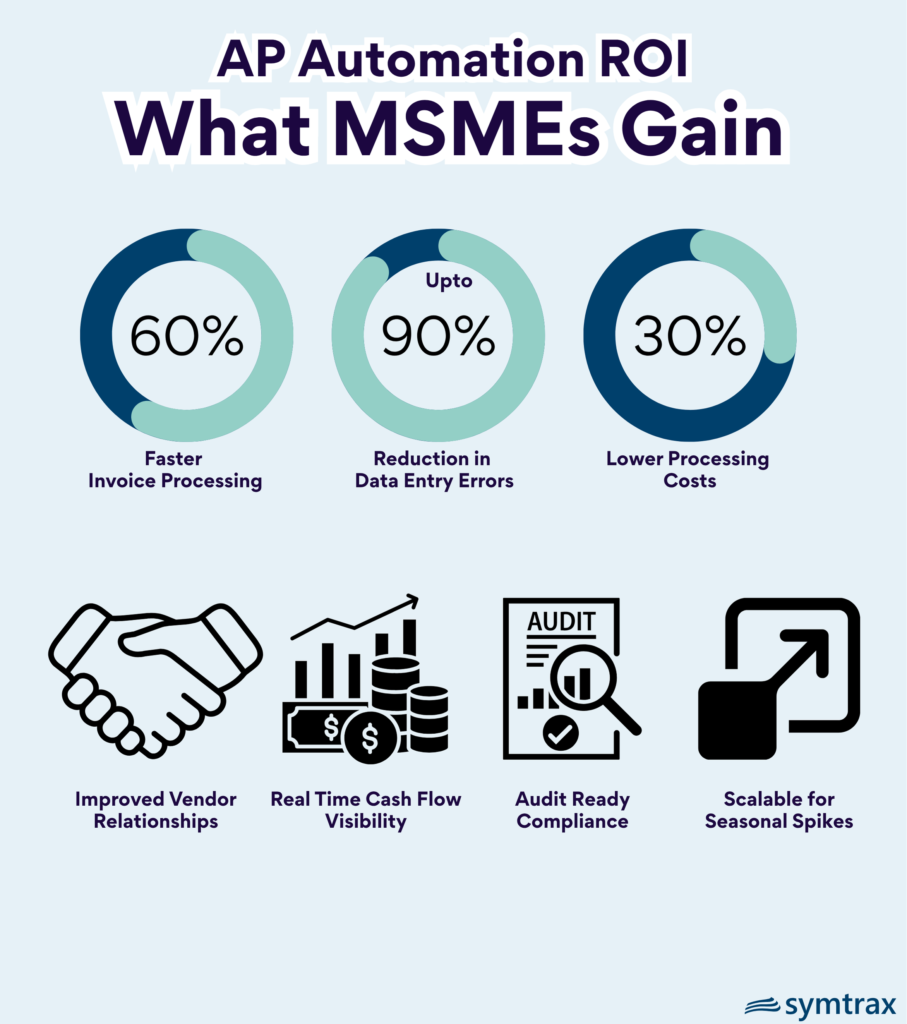

Industries such as manufacturing and automotive are seeing major gains from automating accounts payable. It is anticipated that almost 60% of MSMEs will switch to digital transformation by 2025 to address workforce constraints and reduce errors associated with manual processing. By shifting from paper-based to cloud-based AP tools, these businesses have

- No data entry mistakes with the automated capture and processing of invoices.

- Save more than 60% on invoice processing time to facilitate quicker payments.

- Accelerated invoice approvals using AP workflow software

- Streamlined 3-way matching, even with limited staff resources

- Improved visibility and control over cash flow and payment schedules

- Enhanced compliance and audit readiness, minimizing manual errors and missing documents

- Saved costs by avoiding late fees, duplicate payments, and paper handling.

MSMEs are thriving with AP automation—streamlined, secure, and smarter solutions are driving this digital shift. Learn how

What AP Digitization Looks Like in Practice

Digitizing accounts payable isn’t just about going paperless; it’s about transforming the entire AP lifecycle for accuracy, speed, and control. A modern AP automation solution brings together multiple capabilities to streamline operations and improve visibility.

This digital shift helps MSMEs streamline their workflows, improve coordination with vendors, and stay agile in a fast-changing market.

Key capabilities include:

- Time is saved and errors are decreased when manual entry is eliminated through automated invoice scanning and data capture.

- With AI, businesses can flag anomalies early, safeguard against fraud, and make more informed decisions.

- Paperless and cloud-based invoicing enable remote access and faster turnaround times.

- Automated workflows direct invoices through preset approval stages, helping reduce delays.

- Seamless ERP integration with systems like SAP Business One and SAP H4/HANA ensures real-time syncing of financial data.

- Built-in compliance controls, complete audit trails, and secure data handling help meet regulatory standards effortlessly.

Explore how AI and no-code platforms are shaping AP automation.

How to Get Started with AP Digitization

Mid-sized businesses can no longer rely on manual AP processes. With rising invoice volumes, evolving compliance mandates, and hybrid work models, automation is essential. A solution like Compleo Invoice Platform (CIP) helps streamline invoice processing, automate 3-way matching, and integrate seamlessly with ERPs like SAP Business One, S4/HANA, Microsoft Dynamics 365, Oracle NetSuite, etc.

By digitizing accounts payable workflows, businesses can achieve measurable ROI, reducing costs and minimizing penalties. Automation leads to faster invoice approvals, fewer errors, and reduced reliance on manual manpower.

Conclusion: The Time to Act Is Now

Manual AP is no match for today’s business demands. With rising invoice volumes, evolving compliance needs, and vendor expectations at an all-time high, digitization is no longer optional for MSMEs.

Request a one-on-one demo of Compleo Invoice Platform (CIP) and learn how your business can benefit:

- Eliminate manual bottlenecks.

- Achieve real-time cash flow visibility.

- Automate compliance and approvals.

- Sync seamlessly with your ERP system.