Malaysia’s move towards e-invoicing is driven by a combination of economic, technological, and regulatory factors, all aimed at fostering a more digitally advanced, efficient, and globally competitive business landscape. In commitment to instituting clean tax practices and advancing digitization initiatives, the Malaysian Inland Revenue Board (IRB) has announced the mandatory implementation of e-invoicing for enterprises, contingent on their annual turnover. The current IRB implementation will primarily focus on direct taxes to ensure compliance.

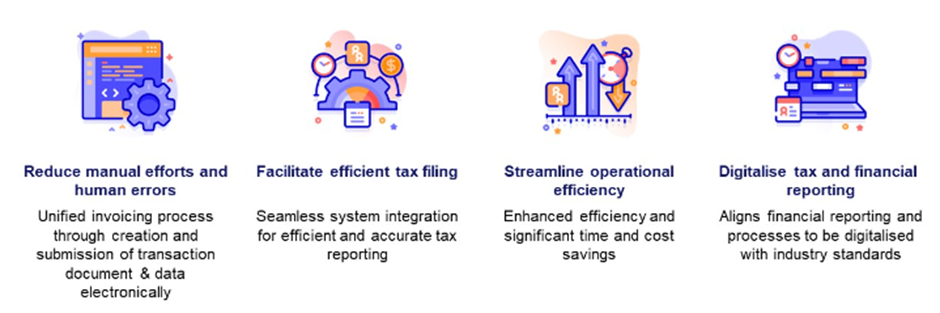

Benefits of e-invoicing

The aim of the e-invoicing mandate is to provide numerous advantages to corporate and individual taxpayers, ensuring a successful journey toward digitization.

In a nutshell, here are a few benefits of adopting e-invoicing:

Source: Official Portal Inland Revenue Board of Malaysia

The Malaysia authorities have also announced tax incentives and grants for Micro, Small and Medium-sized Enterprises (MSMEs) related to the implementation of e-Invoices in the Budget 2024:

- Digitization grant: MSMEs are eligible to receive RM5,000 each for upgrading their sales systems, inventory systems, and digital accounting systems.

- Capital allowance: Effective from YA2024, the capital allowance claim period and rate is reduced to 3 years with a 40% initial and 20% annual allowance, respectively for ICT equipment, software, and related consultation and licensing fees.

- Tax deduction: From YA2024 to YA2027, MSMEs can enjoy a tax deduction of up to RM50,000 each assessment year for ESG-related expenditures, including consultation fees for e-invoice implementation.

To facilitate efficient execution and provide businesses with sufficient preparation time, the adoption of e-invoicing will occur in phases and is expected to be fully integrated by July 1, 2025.

The above implementation timeline is based on the annual turnover or revenue determined based from the financial year 2022.

Types of transactions and documents that are covered under Malaysia’s e-invoicing:

All commercial activities, including the sale of goods and services, as well as non-commercial transactions between individuals, are covered by e-invoicing.

Scenarios that require e-invoice to be issued are:

- Proof of Income: Document issued whenever a sale or other transaction is made to confirm taxpayers’ income.

- Proof of Expense: Expense document issued upon purchases, spendings, returns, and discounts and can be used to reconcile income receipts. Taxpayers are required to issue self-billed e-invoices for specific expenses like, foreign transactions, when the supplier doesn’t use Malaysia’s MyInvois system.

- Typical transaction types covered under e-invoice implementation include:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Business-to-Government (B2G)

- Mandatory for businesses engaging in both domestic and cross-border transactions, including services, goods, and specific non-business transactions such as property trust, co-operative societies, corporations etc.

- E-invoicing shall not be applicable to some entities like rulers, former rulers, government bodies, local authorities, and diplomatic offices as they are currently exempt from issuing e-invoices. Refer the IRBM e-invoice guidelines for detailed list of exempted entities.

- Invoices, credit notes, debit notes and refund notes are the types of documents that fall under the scope of Malaysia e-invoice.

Some of the key requirements for e-invoicing in Malaysia:

Understanding and meeting the key requirements is important for businesses seeking to successfully implement e-invoicing in Malaysia and adhering to regulatory standards.

- A Digital Certificate is a mandatory requirement for e-Invoicing in Malaysia. It is issued by IRBM based on the taxpayer’s TIN and additional information, ensuring the authenticity and integrity of the e-invoice.

- An e-invoice must be issued by a seller with 34 mandatory fields and 17 optional fields based on specific conditions. These fields are grouped into nine (9) categories:

- Address

- Business Details

- Contact Number

- Invoice Details

- Parties

- Party Details

- Payments Info

- Products/Services

- Unique ID Number

E-invoice must adhere to the XML or JSON format as specified by IRBM that can be automatically processed by relevant systems.

- MyInvois System adheres to internationally recognized standards for information security and business continuity management system.

In conclusion, as you prepare for the upcoming e-invoicing launch, delving into the finer details of its introduction to your business is essential. This sets as the foundation for a streamlined and efficient implementation process.

Stay proactive, stay informed, and navigate the e-invoicing landscape with confidence.