Having traced the comprehensive timeline and explored the various transaction types within Malaysia’s e-invoicing landscape in our previous blog , we now venture further into the intricate details of invoicing methods and types within this dynamic framework.

Malaysia’s e-invoice system requires the following documents to be issued electronically:

- Invoice: A commercial document detailing transactions between a supplier and a buyer. This may involve the issuance of a self-billed e-invoice to document an expense.

- Credit note: A document given by a supplier to the customer whenever there is a difference in the original transaction value due to some errors in the invoice, discounts offered, or to address any returns on previously sold goods or services (incorrect or damaged).

- Debit note: A document issued to highlight additional charges on a previous invoice; the debit note serves as a supplementary document to the initial transaction.

- Refund notes: Suppliers issue this document to acknowledge the refund of the buyer’s payment, completing the transaction cycle.

What is the e-invoicing methods in Malaysia?

In Malaysia, companies can transmit invoices to the IRBM via two methods – MyInvois Portal or API. The choice between the two depends on factors like the number of transactions a company makes, its technical capabilities, and the customization needs required in its existing system.

Small to medium-sized businesses may find MyInvois Portal more accessible, while larger enterprises may opt for API-based invoicing for easier integration. Here is a quick comparison for a better understanding:

| MyInvois Portal | Application Programming Interface (API) |

| Web based platform hosted by Lembaga Hasil Dalam Negeri Malaysia (LHDN) to send invoices following a pre-defined template. | Enables direct data transmission between the taxpayer and the MyInvois system hosted by LHDN |

| For existing ERP users, it might incur extra costs for upgrades and IT support. Suitable for large businesses to transmit a high volume of transactions. • Schema validation • Business Rule Validation Designed to handle text and character data using the UTF-8-character encoding standard. |

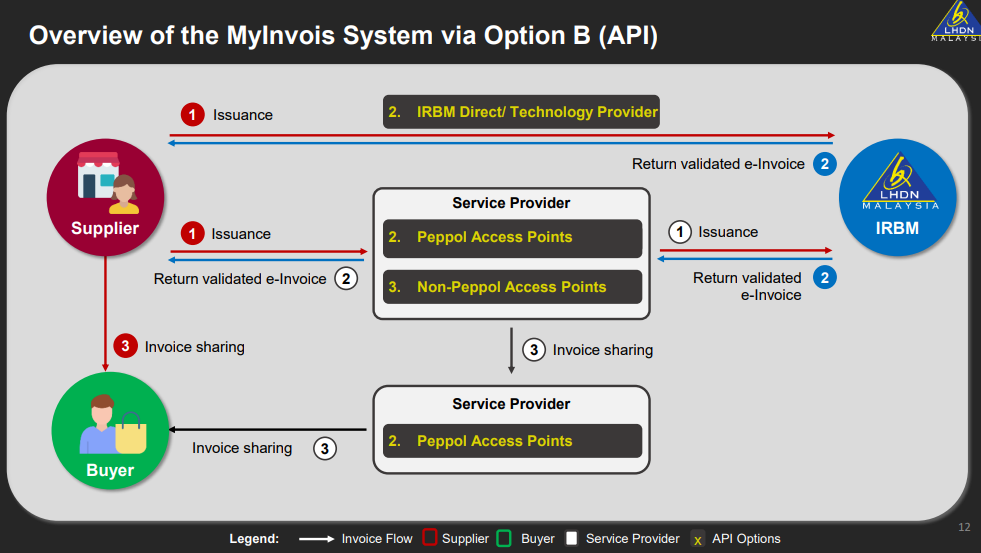

Following are the three different methods to transmit e-invoices via API:

- Direct integration of the taxpayer’s ERP system with the MyInvois system: Using API direct integration, data can be synchronized between the ERP and the MyInvois portal in close to real-time.

- Through Peppol service providers : Leveraging PEPPOL’s interoperability, suppliers can submit e-invoices to LHDNM via Peppol service providers.

- Through non-Peppol technology providers: Businesses can submit e-invoices to LHDNM via non-Peppol technology providers, such as other ERP systems.

By implementing any of these transition methods, the invoicing process becomes more efficient and transparent, with a positive impact on both businesses and the Malaysian tax system.

Here is a general overview of the e-invoice transmission workflow using the MyInvois Portal and API:

E-Invoice transmission workflow in MyInvois System

Source: LHDNM_ACCA e-invoice Webinar

E-invoicing sets up a validation framework each time the supplier generates and transmits an e-invoice to IRBM through the MyInvois Portal or API. Once validated, IRBM issues a unique identifier number for the invoice to the supplier. It is mandatory for the supplier to furnish this validated e-invoice, along with a QR code supplied by IRBM, to the buyer. The QR code can be scanned to verify the status and presence of the e-invoice.

In certain B2C transactions where e-invoices are not required by the end consumers, suppliers will be allowed to issue a normal receipt or provide a QR code that the consumer can scan to obtain the e-invoice for tax purposes.

Conclusion

Are you concerned that e-invoicing will burden you with compliance requirements? Fret not, as this initiative will confer numerous advantages upon taxpayers, enabling them to streamline their invoicing processes and mitigate errors inherent in traditional paper-based systems. Beyond bolstering taxation compliance, it will also contribute to enhancing overall business efficiency, fostering greater ease of doing business for entities engaged in international trade. According to a research report, taxpayers can save up to 65% on invoicing processing cost and reduce average processing time by 12 days by adopting an e-invoicing system.

Are you ready to adopt these changes? Read our carefully curated blog for more information on best practices involved in the e-invoicing adoption journey providing a head start to your readiness.