“Still think e- invoicing in Malaysia is far off? It’s already reshaping how businesses report and manage tax.”

Malaysia’s move towards e-invoicing (or e-invoicing Malaysia) is driven by a combination of economic, technological, and regulatory factors, all aimed at fostering a more digitally advanced, efficient, and globally competitive business landscape.

This 2025 update reflects the latest IRBM guidelines, new Peppol standards, MyInvois Portal 2.1 guidance, and an exemption threshold raised to RM 500 K critical changes for businesses, especially MSMEs.

In commitment to instituting clean tax practices and advancing digitization initiatives, the Inland Revenue Board (IRB) has announced the mandatory implementation of e-invoicing in Malaysia for enterprises, contingent on their annual turnover. The current IRB implementation will primarily focus on direct taxes to ensure compliance.

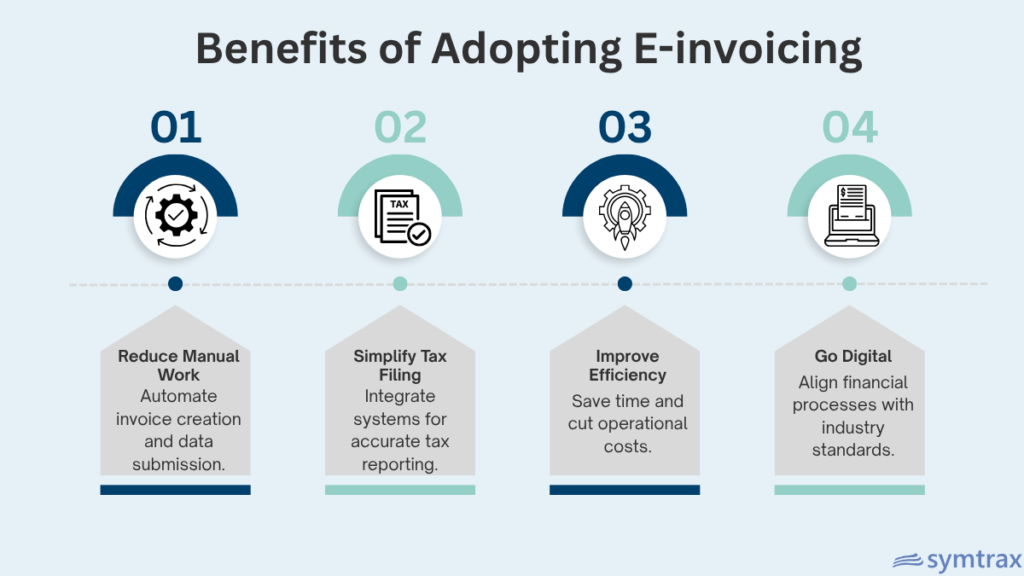

Key Benefits of E-Invoicing

The aim of the Malaysia e-invoicing mandate is to provide numerous advantages to corporate and individual taxpayers, ensuring a successful journey toward digitization.

In a nutshell, here are a few benefits of adopting e-invoicing:

Ready to take the next step? Learn how to create, submit, and validate e-invoices in Malaysia in this step-by-step guide.

The Malaysian authorities have also announced tax incentives and grants for Micro, Small, and Medium-sized Enterprises (MSMEs) related to the implementation of e- invoices in the Budget 2024:

- Digitization grant: MSMEs are eligible to receive RM5,000 each for upgrading their sales systems, inventory systems, and digital accounting systems.

- Capital allowance: Effective from YA2024, the capital allowance claim period and rate is reduced to 3 years with a 40% initial and 20% annual allowance, respectively, for ICT equipment, software, and related consultation and licensing fees.

- Tax deduction: From YA2024 to YA2027, MSMEs can enjoy a tax deduction of up to RM50,000 each assessment year for ESG-related expenditures, including consultation fees for e-invoice implementation.

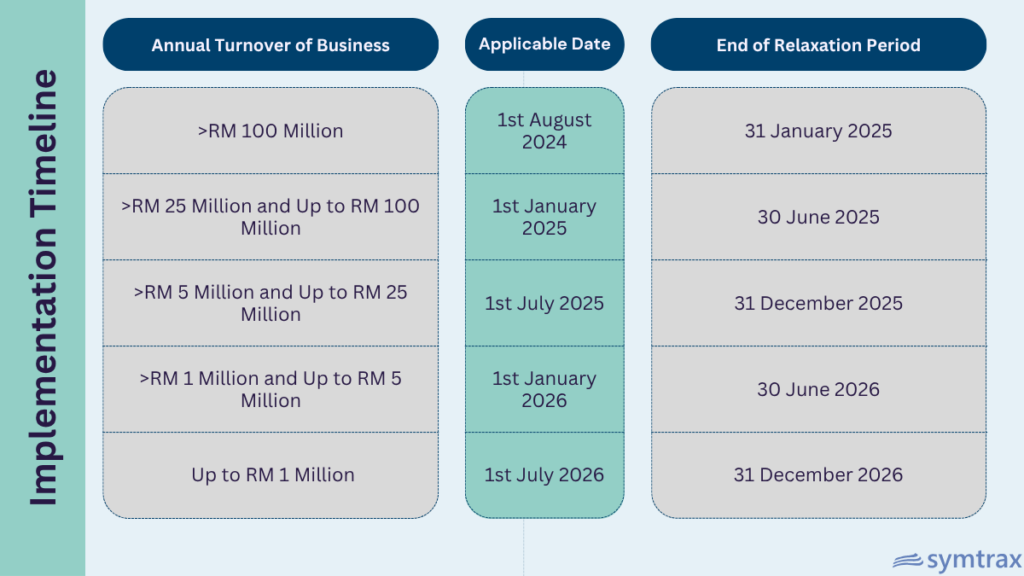

To facilitate efficient execution and provide businesses with sufficient preparation time, the adoption of e-invoicing will occur in phases and is expected to be fully integrated by July 1, 2026.

What is the timeline for e-invoicing in Malaysia?

Here is the updated timeline and relaxation period as per the latest IRBM guidelines (June 2025):

The above implementation timeline is based on the annual turnover or revenue determined from the financial year 2022.

Types of transactions and documents that are covered under Malaysia’s e-invoicing:

All commercial activities, including the sale of goods and services, as well as non-commercial transactions between individuals, are covered by e-invoicing.

Scenarios that require an e-invoice to be issued are:

- Typical transaction types covered under e-invoice implementation include:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Business-to-Government (B2G)

- Invoices, credit notes, debit notes, and refund notes are the types of documents that fall under the scope of Malaysia’s e-invoice.

- Proof of Income: Document issued whenever a sale or other transaction is made to confirm taxpayers’ income.

- Proof of Expense: Expense document issued upon purchases, spendings, returns, and discounts and can be used to reconcile income receipts. Taxpayers are required to issue self-billed e-invoices for specific expenses, like foreign transactions, when the supplier doesn’t use Malaysia’s MyInvois Portal.

- Mandatory for businesses engaging in both domestic and cross-border transactions, including services, goods, and specific non-business transactions such as property trusts, co-operative societies, corporations, etc.

5 Key requirements for Compliance

Understanding and meeting the key requirements is important for businesses seeking to successfully implement e-invoicing in Malaysia and adhere to regulatory standards.

- A digital certificate is a mandatory requirement for e-invoicing in Malaysia. It is issued by IRBM based on the taxpayer’s TIN and additional information, ensuring the authenticity and integrity of the e-invoice.

- An e-invoice must be issued by a seller with 55 mandatory fields and 17 optional fields based on specific conditions. These fields are categorized into eight (8) categories:

- Address

- Business Details

- Contact Number

- Invoice Details

- Parties

- Party Details

- Payment Info

- Products/Services

- E-invoices must follow the IRBM-specified UBL 2.1 format (XML or JSON), which the appropriate systems may process automatically.

- Each validated e-invoice via the MyInvois Portal receives a Unique ID and QR code, ensuring legal compliance. The portal follows global standards for data security and reliable e-invoice processing in Malaysia.

- Businesses are required to securely store digital copies of all e-invoices for a minimum of seven years to ensure audit readiness and compliance.

Technical Specifications and Integration Options

In July 2025, the Malaysian Digital Economy Corporation (MDEC) and OpenPeppol released an updated version of Peppol PINT‑MY (v1.2.0), enhancing support for self-billing under the Peppol network, under the Malaysian localization. It enables Malaysian taxpayers to exchange both billing documents (invoices and credit notes) and self-billed invoices seamlessly across the approved Peppol Network, enhancing cross-border and domestic interoperability.

FAQ

Peppol (Pan-European Public Procurement On-Line) serves as a collection of technical standards that can be incorporated into current eProcurement solutions or Enterprise Resources Planning (ERP) systems, ensuring seamless compatibility across systems across different countries.

PINT (Peppol International Invoice) serves as a new specification enabling global interoperable invoicing standards for the Peppol Network.

MyInvois Portal is Malaysia’s official e-invoice platform provided by IRBM to facilitate real-time validation and tracking of e-invoices. It supports structured formats like XML and JSON for seamless integration with accounting systems.

Symtrax offers a globally trusted e-invoicing solution that ensures:

Seamless integration with ERPs

Compliant with formats (XML/JSON)

Secure document exchange (EDI)

Easy onboarding for MyInvois Portal connectivity

Yes. As per IRBM e-invoice guidelines, entities such as foreign diplomatic offices, non-business individuals, international organizations (for transactions before July 1, 2025), statutory bodies, and taxpayers with annual turnover below RM500,000 are currently exempted from e-invoicing.

Refer to the IRBM e-invoice guidelines for the full exemption list.

Understand Malaysia’s e-Invoicing Guidelines and How to Implement Them Effectively