The Oman Tax Authority (OTA) has introduced Oman e-invoicing to move businesses away from paper and PDF files towards electronic invoices. Developed in partnership with Omantel, Fawtara will serve as the national e-invoicing platform. Every invoice will now be created and sent digitally, making compliance simpler and record-keeping cleaner for VAT-registered businesses.

This initiative aims to strengthen tax compliance, reduce fraud, and promote transparency in business transactions. It also supports Oman’s digital transformation, enabling real-time invoice validation, fewer manual errors, and better interoperability with international systems.

For organizations operating in Oman, understanding what e-invoicing means and preparing early is crucial for ensuring compliance, data security, and uninterrupted business operations.

What is E-invoicing in Oman?

E-invoicing refers to the electronic creation, exchange, and validation of invoices in a structured digital format. Unlike PDF or paper invoices, e-invoices follow a standardized format that can be automatically processed by accounting systems and verified for tax reporting.

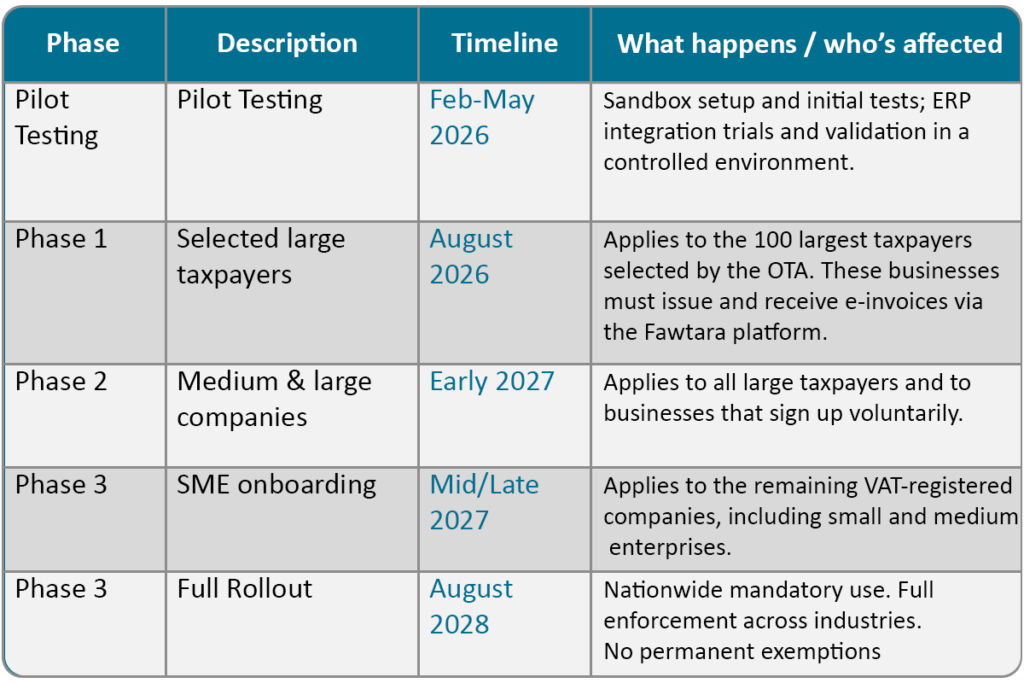

- Phased rollout begins in 2026, starting with VAT-registered large businesses and focusing first on B2B transactions, followed by B2G e-invoicing in the subsequent phase in 2028.

- Invoice should include all OTA-mandated fields (VATINs, transaction details) and support required structured formats (XML/JSON or OTA-specified schema).

- E-invoices must be generated directly from your accounting or ERP software (no manual uploads).

This model is similar to other global systems, like Peppol e-invoicing and ZATCA e-invoicing, built to improve transparency and security across the region. As Oman rolls out the e-invoicing regulation, companies will need the right process and technology to stay compliant, including reliable e-invoice integration with ERP and a secure e-invoicing platform.

Here is the phase-by-phase breakdown of Oman e-invoicing.

What is Implementation timeline & Roadmap for Oman e-invoicing?

How to Prepare for E-invoicing in Oman?

E-invoicing implementation in Oman (Fawtara) needs both regulatory requirements and technical readiness. Below are requirements you can use as a checklist.

1. Register and Confirm Scope

Confirm VAT registration and where your business falls into the phased rollout. Register with the (OTA) if required.

2. Confirm ERP Capability

Check whether your ERP can export structured XML or JSON formats. If not, identify middleware or a connector for e-invoice integration with ERP.

3. Capability Choose an OTA Accredited Service Provider

Select a Fawtara-approved e-invoicing platform to transfer invoices to OTA in real time.

4. Configure and Test the System

Run test cycles between your ERP, e-invoicing solution, and the Fawtara platform to ensure smooth data flow and proper OTA validation before go-live.

5. Archiving and Record Retention

Ensure your system can securely store all e-invoices and retain them for at least 10 years for audit and verification.

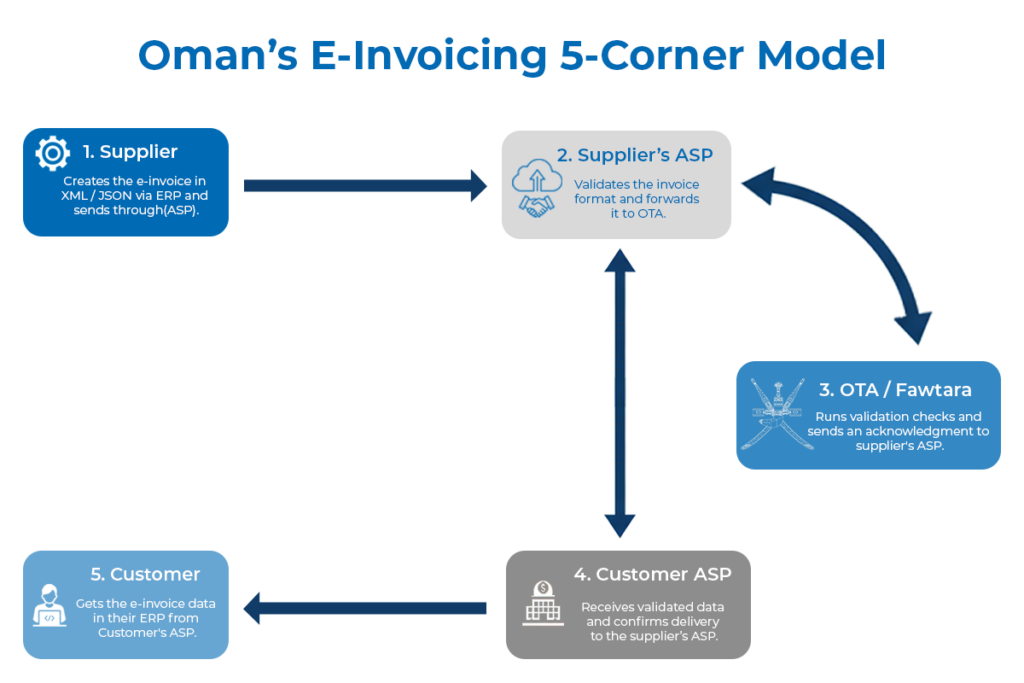

Oman’s E-Invoicing 5-Corner Model

1. Corner 1: Supplier

The supplier creates the e-invoice in their ERP or accounting system in XML or JSON format and initiates the invoicing process via ASP.

2. Corner 2: Supplier’s Accredited Service Provider (ASP)

The supplier’s ASP receives the invoice, checks it for basic format and schema errors, and forwards it to the Oman Tax Authority (Fawtara) for validation.

3. Corner 3: OTA / Fawtara system (central exchange)

Fawtara receives the invoice and runs validation checks and returns acknowledgement to the supplier’s ASP that the invoice has been received.

4. Corner 4: Customer’s Accredited Service Provider (ASP)

The customer’s ASP receives the validated invoice data from the supplier’s ASP and returns acknowledgment back to the supplier’s ASP.

5. Corner 5: Customer (buyer)

The customer ERP obtains the invoice data received from the customer’s ASP.

Who will be affected?

Initially, large enterprises and medium-sized businesses will be among the first to comply. However, once the system matures, all VAT-registered businesses in Oman are expected to adopt e-invoicing. This includes:

- Retail and wholesale companies

- Service-based organizations

- Industrial and manufacturing sectors

- Public sector entities dealing with VAT invoices

How can partnering with Symtrax can help?

With over 35 years of expertise across 6 countries, Symtrax brings proven global experience in e-invoicing, including successful implementations across Saudi Arabia’s ZATCA, the UAE, Malaysia’s MyInvois, GSTN E-Invoicing India, and several European VAT networks aligned with PEPPOL standards. Our e-invoicing solution helps organizations meet Oman’s Fawtara e-invoicing requirements with ease and compliance.

Our digital solution covers every essential step: certificate integration, format conversion (XML, JSON, PDF), API-based uploads, and government verification, while ensuring invoices match your customer’s regional requirements. With our solution, you can convert, validate, and share invoices across borders, making e-invoicing simpler.

Book a demo to see how we simplify your transition to Oman’s Fawtara e-invoicing system.

FAQ

E-invoicing means issuing invoices in a digital format, which are then sent automatically between the seller, customer, and tax authority for validation, replacing paper invoices or PDfs.

All VAT-registered businesses must get ready for e-invoicing. The rollout starts with large taxpayers and will later include medium and small enterprises.

Review your ERP system, choose an OTA accredited service provider, and test e-invoice generation in XML or JSON formats to ensure compliance with the Fawtara platform.

E-invoicing reduces manual work and errors, speeds up approvals, and keeps businesses VAT-compliant. It also improves cash flow, audit readiness, and overall invoice visibility.

Invoices can be issued in Arabic or bilingual formats (Arabic and English) to meet Oman Tax Authority (OTA) requirements.

You’ll need ERP software capable of producing structured XML or JSON invoices, along with integration to an OTA-approved e-invoicing solution.

Non-VAT-registered entities & Micro-businesses below the VAT registration threshold and certain government entities are currently exempted.

Yes. Any business exceeding the OMR 38,500 VAT threshold must comply.

Integration Specifications will be provided for updating existing systems.

Use an e-invoicing tool with built-in validation to check your data before submission. Make sure all key fields, like VATINs, etc., are complete and accurate.