- SAP DRC: The SAP E-Invoicing Solution

- The Strengths and Limitations of SAP DRC

- Deployment Challenges of SAP DRC

- Compleo Invoice Platform: An Agile, Non-Intrusive Alternative Seamlessly Integrated with SAP for the receipt and processing of supplier invoices

- CIP Connected to SAP for Customer Invoices

- Rapid Implementation

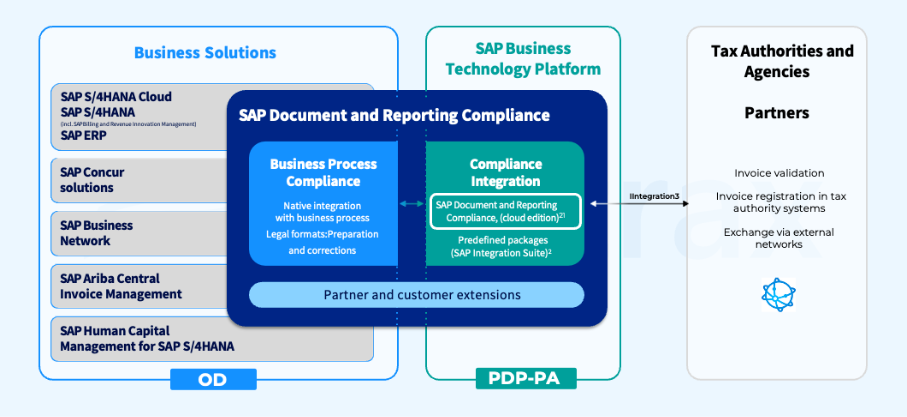

The widespread adoption of electronic invoicing around the world is forcing companies to undergo a rapid and essential transformation of their invoicing processes. Organizations using SAP (whether ECC or S/4HANA) must adapt their tools to guarantee both compliance and operational efficiency. In this context, SAP promotes its Document and Reporting Compliance (DRC) tool as the standard solution for meeting these legal requirements; however, this solution presents certain limitations.

Therefore, some organizations choose external solutions that integrate with SAP.These alternatives are often more flexible, faster to deploy, and specifically designed to automate the entire invoicing process

SAP DRC: The SAP E-Invoicing Solution

SAP designed its native Document and Reporting Compliance (DRC) solution to help companies meet global e-invoicing and reporting obligations.

The Strengths and Limitations of SAP DRC

This solution centralizes all customer invoices, regardless of country, format, or regulatory framework. It offers real-time monitoring of all documents, ensuring traceability, integrity, and compliance of the transmitted data.

However, SAP DRC has several limitations. While it can retrieve supplier invoices from government portals (like KSeF (Poland), SdI (Italy), Chorus Pro (France), the GST Network (India), ZATCA (Saudi Arabia), or emerging systems like Fawtara (Oman), MyInvois (Malaysia), and the UAE e-invoicing system, ) it does not handle business processing. It does not automate critical tasks like verification, matching, GL coding, validation, and posting. Thus, accounting teams are required to handle these operations manually, forcing companies to manage supplier invoices in several steps.

Deployment Challenges of SAP DRC

The current high demand for SAP DRC integration highlights a skills shortage among consultants, who are not yet proficient with the solution. This constraint is particularly acute for companies that use systems external to SAP: DRC only reads the UBL format that conforms to its internal model, making a costly and complex conversion mandatory if the product format is different.

Faced with these limitations, many companies are seeking a solution that ensures compliance while fully automating invoice management in SAP.

Compleo Invoice Platform: An Agile, Non-Intrusive Alternative Seamlessly Integrated with SAP for the receipt and processing of supplier invoices

Compleo Invoice Platform (CIP) is a flexible, no-code, business-oriented solution designed to automate the processing of both supplier and customer invoices. Rapid to deploy, CIP is built on three robust technical pillars for supplier invoice management, forming an architecture that integrates seamlessly with SAP while ensuring compliance and operational efficiency.

Pillar 1 – SAP Master Data Import

CIP automatically synchronizes all data from SAP. Upon deployment, an initial import populates CIP with all the “Master Data” required for invoice processing:

- Vendor Data: Including payment terms, bank details, etc.

- Purchasing Data: Purchase Orders (POs), along with delivery history (Goods Receipts) and invoicing history.

- General Ledger (GL) Accounts.

- Analytical Dimensions: For management control (cost centers, projects, networks, etc.)

- Tax Codes: Including percentages and descriptions.

How does this synchronization work?

Once the initial database is established, a synchronization module regularly updates the data via BAPI* calls to the SAP database, based on a frequency defined during configuration.

Furthermore, if needed, the user can trigger synchronization directly from the CIP interface to retrieve the most recent data, ensuring the full potential of CIP is utilized.

*BAPI: Business Application Programming Interface – an interface allowing an external system to read or write data in SAP.

Pillar 2 – Pre-processing and Enrichment of Invoices in CIP

CIP manages every step of the supplier invoice process, from receiving invoices to payment.

a. Intelligent Data Capture & Verification

Upon receiving the invoice, structured files are interpreted by CIP and converted into a human-readable format for verification. For unstructured formats (PDF or paper invoices), documents are processed using AI-powered OCR.

Regardless of the invoice format (structured or unstructured), the extracted data is compared against the master data imported from SAP. Any discrepancies with SAP data are flagged, including variances in line items or delivered quantities.

b. Analytical Allocation

Users can split an invoice across multiple cost centers, projects, etc., or correct an existing accounting or cost allocation.

c. Approval Workflow (Good to pay)

All stakeholders involved in invoice approval interact directly within CIP, adding attachments if necessary. The entire history of these exchanges is subsequently transmitted to SAP to create a reliable audit trail, ensuring complete traceability.

Pillar 3 – SAP Integration

Once validated, the invoice is automatically sent to SAP. Compleo handles the execution of the appropriate BAPI call for integration (MIRO or T-code FB60). The no-code approach makes this step very simple: no ABAP skills are required.

As soon as SAP creates the document, it confirms the successful integration and sends the invoice number to CIP via BAPI. Subsequently, it feeds back invoice statuses and payment information, maintaining full traceability of the invoice lifecycle.

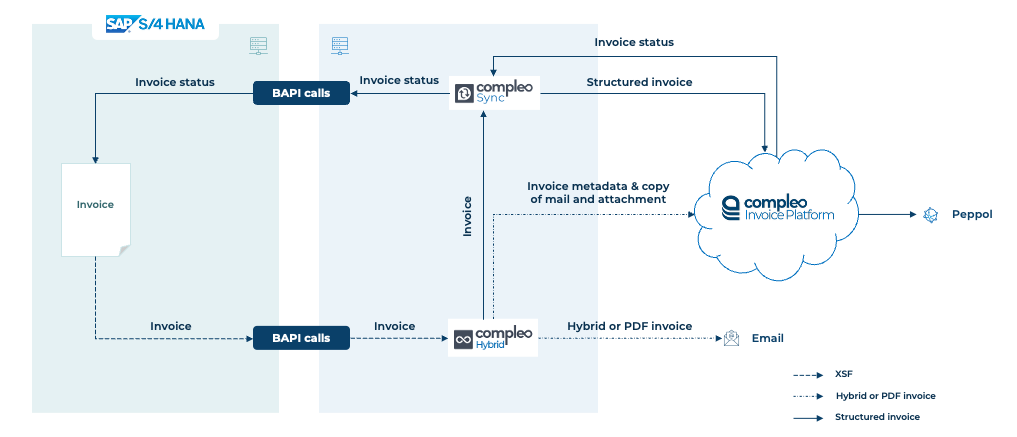

CIP Connected to SAP for Customer Invoices

Symtrax chose to design an external, bidirectional, and non-intrusive solution. For customer invoices, data retrieval from SAP (in XSF format) relies on the BC-XOM connector.

The invoice data is then converted by Compleo into the structured format (CII, UBL, Factur-X, Peppol BIS, ZATCA XML, FatturaPA, and more). CIP issues the invoice via the designated government portals, certified providers, or other required channels depending on local regulations. Finally, it integrates the status updates received by CIP back into SAP using BAPI calls.

The CIP solution integrates easily with your existing infrastructure, regardless of the SAP version used (R/3, ECC, or S/4HANA). It offers a powerful alternative for companies seeking rapid deployment and maximum flexibility in processing customer invoices.

Rapid Implementation

In summary, the CIP enables the management of all customer and supplier invoicing flows through a single SaaS-based interface. From receiving invoices from multiple channels or issuing them to processing and SAP integration, it guarantees invoice integrity and traceability.

Thanks to its “no-code” approach, CIP integrates with SAP to guarantee rapid adaptation to specific client needs without the burden of ABAP development.

The CIP solution can be rapidly deployed, generally within less than 3 months, by Symtrax teams independently, irrespective of the SAP version (SAP ECC or S/4HANA).

Several companies using SAP ECC or SAP S/4HANA have already successfully adopted CIP in a variety of environments.

👉 Read the testimonial: How CIP revolutionized supplier invoice management within Campus Condorcet.

“I am more motivated to do my work with this tool. Compleo has brought us simplicity, practicality, and reliability.”

In France, CIP is an Approved Platform (Plateforme Agréée or PA), ensuring corporate compliance with regulatory requirements.

In addition, Symtrax is a Peppol Access Point, enabling reliable and secure connectivity to the entire Peppol network and the exchange of electronic invoices worldwide.