“A single error in tax calculation. A missing audit trail. A fake vendor invoice.”

These aren’t just small oversights—they’re red flags for auditors and gateways to financial fraud. As regulations tighten and scrutiny deepens, your accounts payable process must evolve from reactive to compliance-audit ready.

Is Your AP Process Ready for Compliance Audit?

Vendor invoicing compliance is the lifeline of a healthy Accounts Payable (AP) process, and when an audit comes knocking, its strength is truly put to the test. With increasing regulations across regions and industries, companies face increasing pressure to comply with a growing number of financial regulations, tax laws, and audit standards.

Manual invoice handling exposes your organization to invoice fraud, late payments, and penalties. More importantly, it can fall short of audit expectations from regulatory bodies like the Auditor General, CAG, or other tax authorities.

With reputational risks and regulatory compliance in invoicing at stake, every ERP-driven company must ask:

Is our accounts payable process truly compliant, secure, and audit-ready?

If you’ve read our blog on invoice automation and how it streamlines accounts payable operations, you’re already aware that automation is more than just efficiency.

What is Invoice Compliance?

Compliance in invoice automation means meeting all legal, tax, and regulatory obligations when processing invoices. Whether you’re managing VAT mandates under France’s PPF (Portail Public de Facturation), e-invoicing rules in the UAE, or U.S. IRS audit standards—your AP system must be aligned. Explore how electronic invoicing is evolving across Europe and shaping global compliance strategies.

Within an ERP environment, digital invoice processing ensures compliance through preconfigured business rules that validate the accuracy of invoice data. It also provides secure and searchable document storage, which supports audit-ready invoicing by maintaining a clear and traceable record. Additionally, automated workflows help reduce manual errors and processing delays, ensuring a smooth and compliant accounts payable process.

Organizations are expected to maintain a complete and accurate audit trail—ready for review by certified internal auditors, accountants and auditors, or accounting firms.

Key Compliance Areas (KPA) in AP Processing

Understanding the KPA in the AP process is essential for financial accuracy, fraud prevention, and avoiding regulatory penalties. Here’s a streamlined breakdown:

1. Payment & Tax Compliance:

Invoices must comply with statutory e-invoicing laws that govern tax accuracy and validation. Automated invoicing solutions streamline this process by applying built-in tax rules, managing country-specific tax requirements, and submitting compliant e-invoices.

2. Regulatory and Legal Compliance:

AP processes must follow SOX, GAAP, labour laws, and data privacy regulations like GDPR, CCPA, and ISO/IEC 27001. These frameworks play a crucial role in strengthening AP data security and audit preparedness. Learn more about the importance of cybersecurity compliance in our blog on How to Protect Yourself from Cyber Threats.

3. Audit Preparedness:

With manual processes, maintaining a clear audit trail and providing timely access to documents is challenging. A compliance-ready AP system ensures real-time tracking, seamless audit system integration, and fast, reliable access for auditors.

4. Fraud Detection & Prevention:

Built-in fraud detection helps catch duplicate invoices, fake vendors, and inflated charges early, protecting your business from financial fraud and non-compliance.

A compliance-focused AP system helps detect anomalies early and enhances fraud prevention.

4 Challenges in Maintaining Invoice Compliance

Ensuring invoice compliance is difficult without automation. Manual systems and ERP setups introduce several risks:

1. Manual Processing Errors:

Paper-based or spreadsheet-driven invoice handling leads to inaccurate entries, delayed approvals, and late payments—frequent triggers for non-compliance. Without invoice processing automation, it’s difficult to ensure vendor invoicing compliance or meet strict accounts payable compliance standards.

2. ERP System Transparency Gaps:

Many ERP systems don’t enforce compliance automatically—you must configure governance rules, integrate them into your workflows, and enable audit trails and dashboards to ensure ongoing audit readiness. Integrating automated invoicing solutions bridges this gap by enabling regulatory compliance in invoicing and real-time visibility.

3. Cross-Border E-Invoicing & Compliance Complexity:

Each country enforces unique e-invoicing mandates—such as France’s 2026 requirement, the UAE’s 2025 rollout, Malaysia’s LHDN framework, KSA’s ZATCA, and evolving standards in the United States. Managing these diverse requirements manually—formats, tax validations, and real-time submissions—can result in errors, delays, and non-compliance penalties.

A digital invoice processing system ensures compliance in invoice automation, standardizing global operations.

Learn more about France | UAE | Malaysia | KSA | USA.

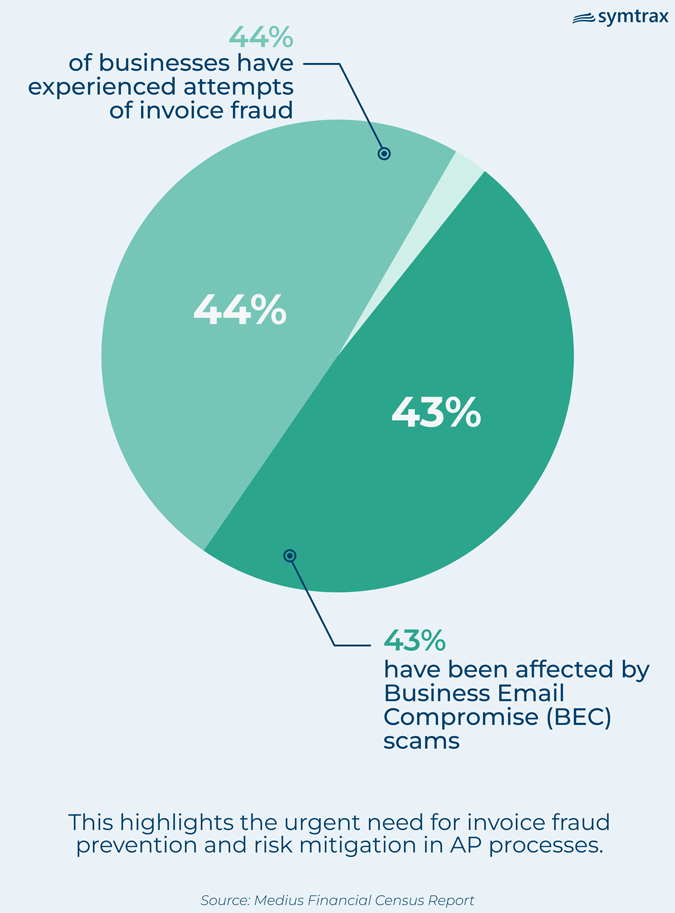

4. Fraud and Scams:

Manual AP workflows lack integrated fraud detection, increasing exposure to counterfeit invoices, overpayment scams, email interception, etc. Strong vendor invoice management combined with invoice fraud prevention capabilities is key to risk mitigation in AP processes.

Learn how automation can protect against fraud in our blog: Preventing Corporate Fraud with Automated AP Financial Workflows.

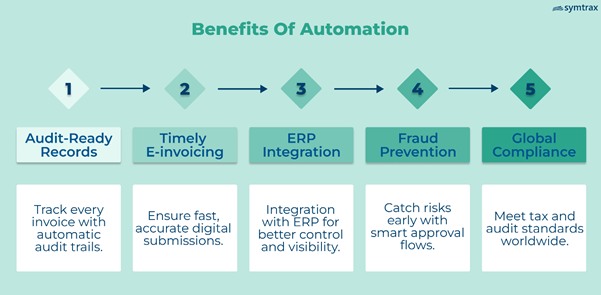

Role of Invoice Automation in Compliance

Invoice processing automation solutions eliminate manual bottlenecks and provide built-in safeguards for compliance. It embeds compliance into every step of the workflow and reduces your dependency on manual processes.

Automation is essential for reducing the risks associated with fraud, such as incorrect billing, duplicate invoicing, and detecting subtle discrepancies in vendor details that manual processes often miss.

Features to Look for in a Compliance-Focused AP Tool

When evaluating a vendor invoice management solution, it’s critical to ensure the tool is built with compliance-first architecture. From facilitating a clear audit trail to supporting real-time document access, the right AP automation tool can drastically simplify regulatory compliance, reduce risk, and improve audit readiness.

Here are essential features to look for:

1. Document Archiving & Change Logging: A compliance-focused AP solution must include version-controlled document archiving with full ERP integration. This helps create a centralized, secure repository for all invoice records—ensuring digital invoice processing is traceable and audit-compliant.

2. Centralized, Searchable Audit Trails: To stay audit-ready, the AP tool should maintain centralized, searchable audit trails. This feature allows both internal and external auditors to trace invoice history instantly, ensuring transparency and accelerating compliance in invoice automation.

3. Real-Time Audit Access: Immediate access to invoice data and supporting documents is essential for meeting accounts payable compliance standards. The tool should provide real-time audit access to comply with standards set by bodies like the Auditor General or CAG audit boards.

4. Business Rule Validations: Advanced AP systems must validate invoices against pre-set business and regulatory rules. These ensure every invoice aligns with invoice processing regulations, improving invoice fraud prevention and eliminating non-compliance risks before payment approval.

Conclusion

Invoice compliance is not just about following the rules—it’s about protecting your business. Whether you’re preparing for a tax audit, an internal controls review, or an external financial inspection, your accounts payable (AP) process must be transparent, efficient, and fully aligned with evolving invoice processing regulations.

Traditional ERP systems offer basic transaction support but often fall short in delivering the compliance in invoice automation, fraud prevention, and audit-ready invoicing systems that modern organizations demand.

Want to strengthen your AP compliance and reduce risk?

Discover how Compleo Invoice Platform (CIP) helps ERP-driven businesses ensure global invoice compliance, automate audit readiness, and protect against fraud.